📈 Week 31 (29 July - 04 Aug 2024) Market Summary

US Stocks (Major Indices), Sector and Asset Class rotation, The Magnificent Seven, Global Stock Indices, Volatility, Major Economics Announcements and Earnings Reports

Hello! 👋

Let's take a look at what we've been up to this week.

1. US Stocks (Major Indices)

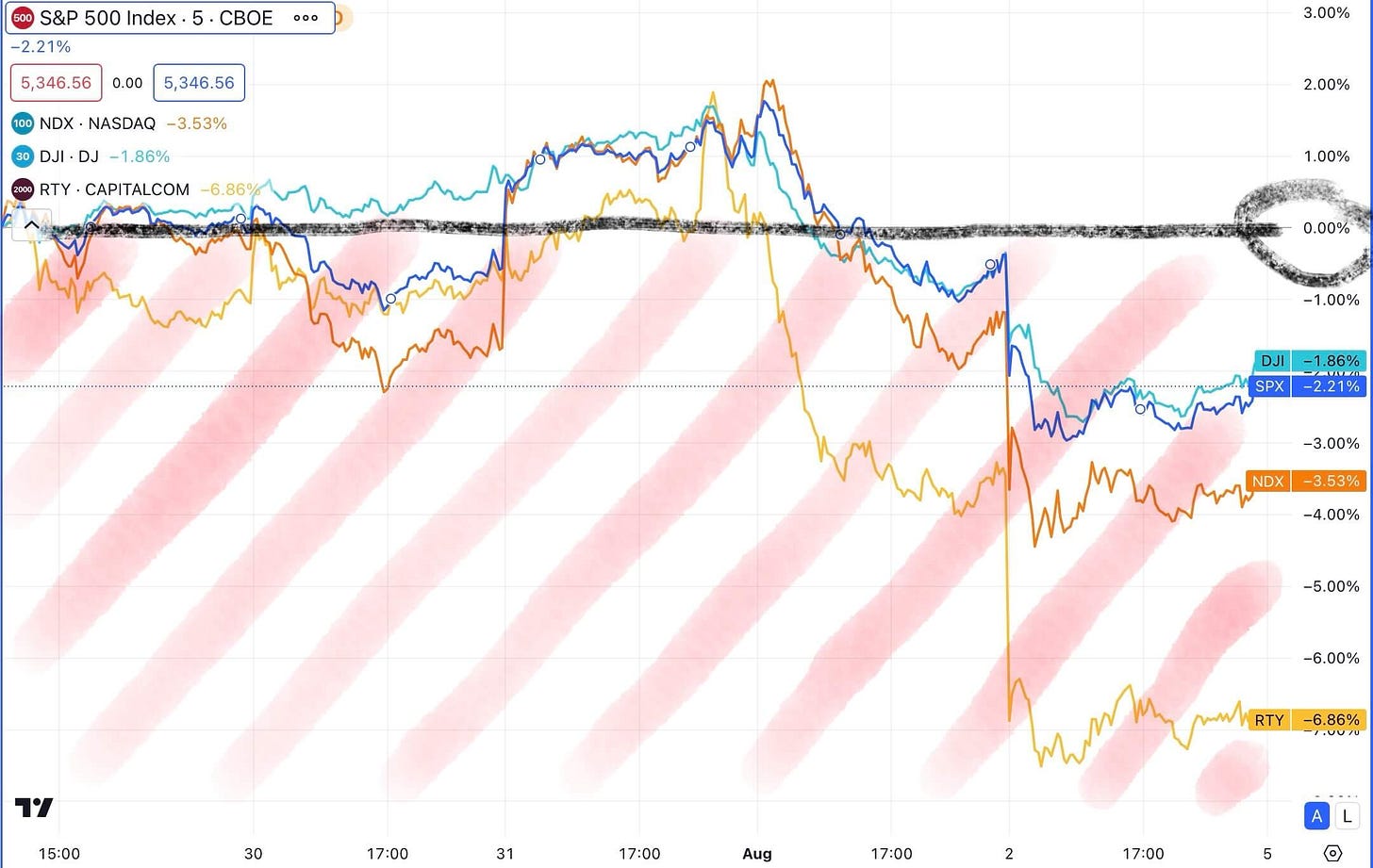

US stocks ended the week in the red. We observed that tech stocks were on sale, with capital rotating into other sectors such as Healthcare, Telecoms, and Utilities.

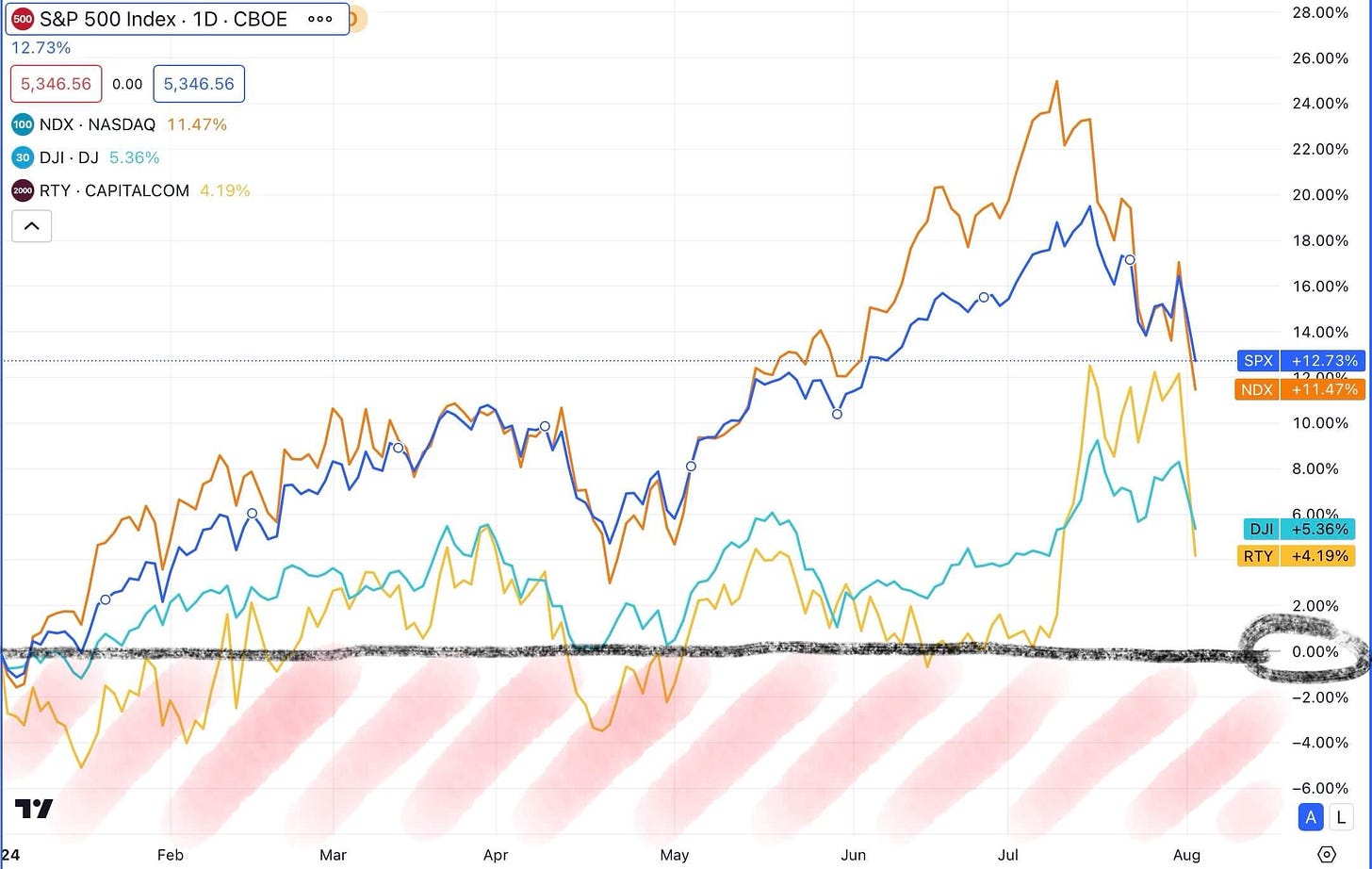

The Russell 2000 lost the most among major US stock indices, dropping 6.86%. The S&P 500 decreased by 2.21%, the Dow Jones Industrial Average fell by 1.86%, and the Nasdaq 100 lost 3.53%.

However, the Nasdaq 100 is still performing well in 2024, having increased by 11.47% this year. The S&P 500 has risen by 12.73%, the Russell 2000 has added 4.19%, and the Dow Jones (DJIA) has grown by 5.36% so far this year.

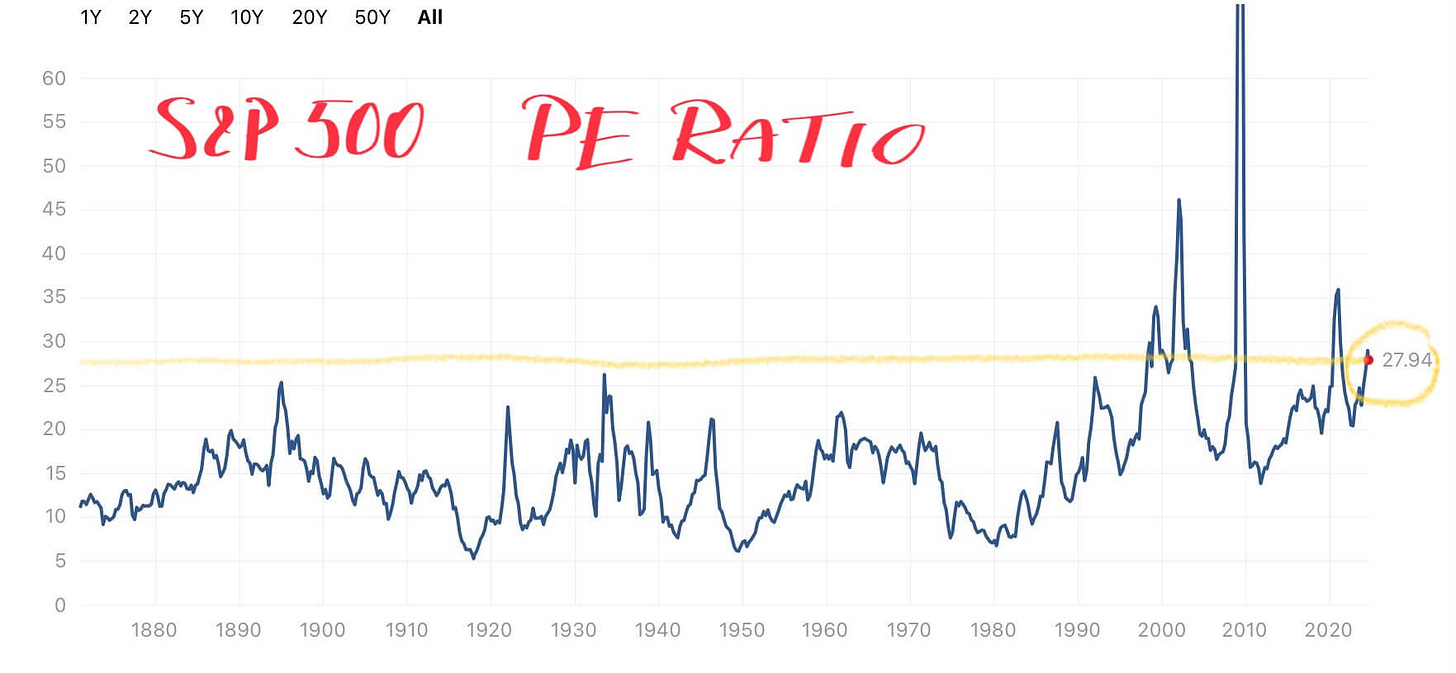

The Price/Earnings Ratio of S&P 500 index companies is currently at 27.94, which is high but not extreme.

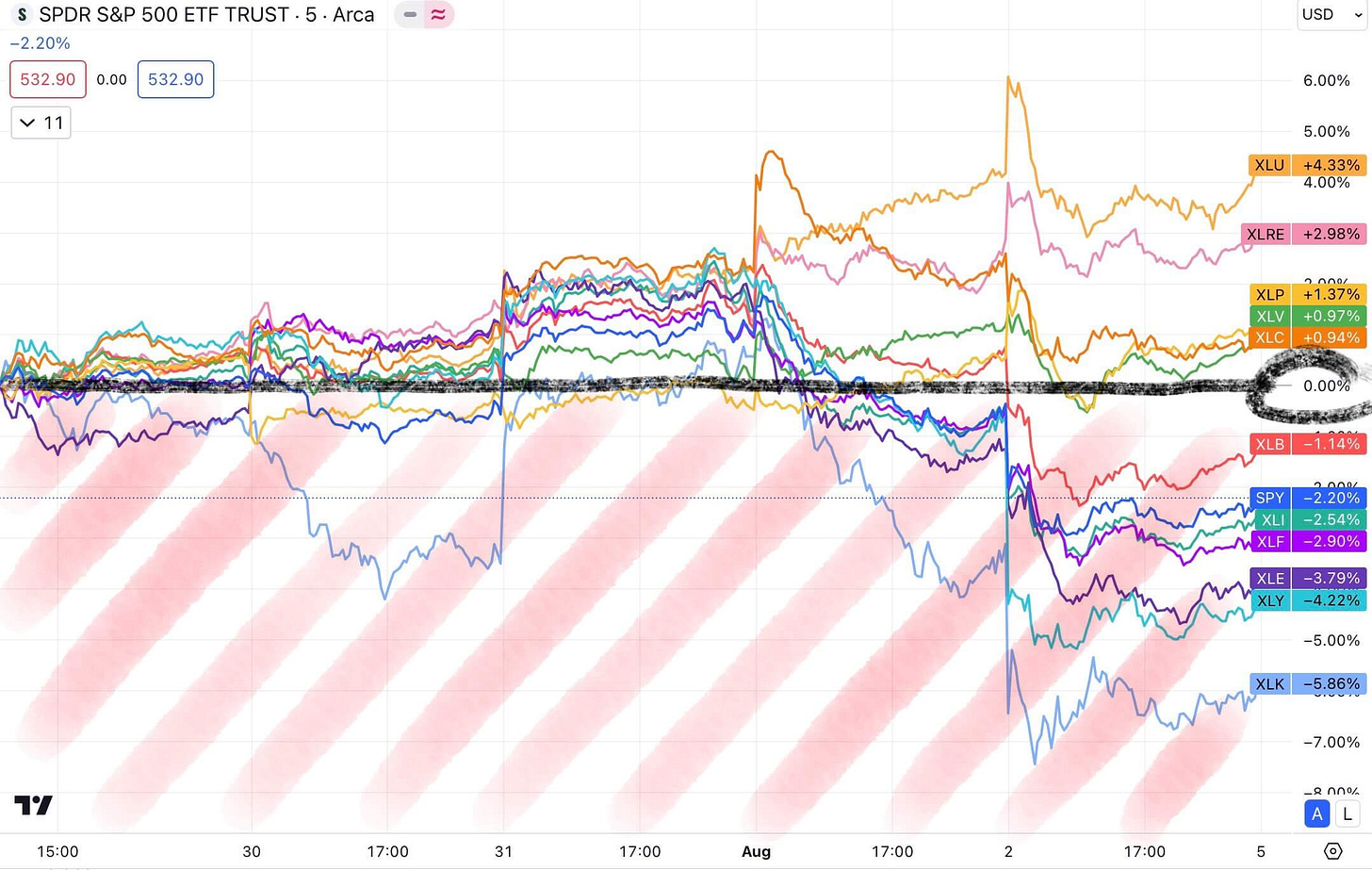

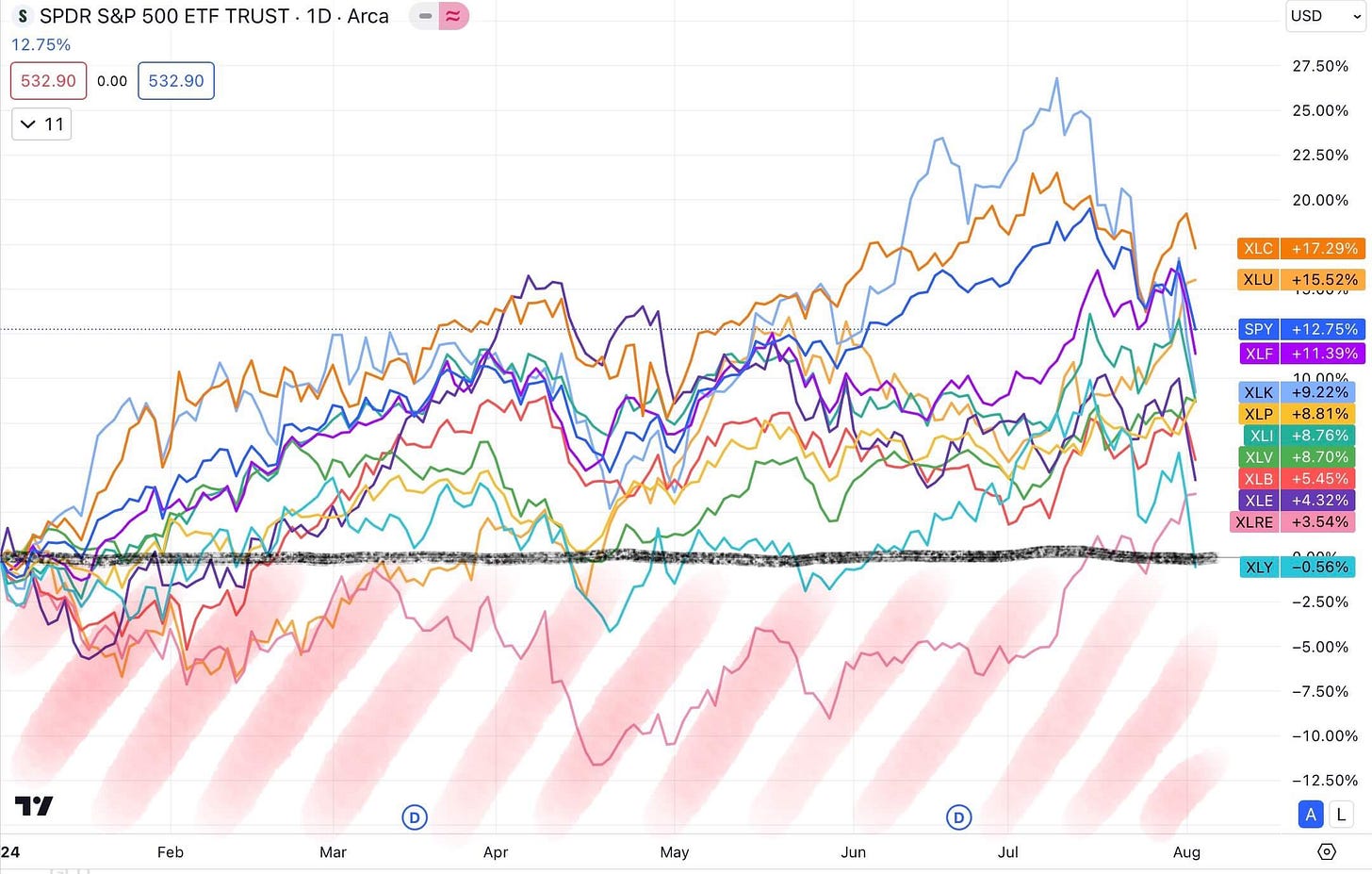

2. US Stocks by Sector

The Technology sector lost the most this week, dropping 5.86%, followed by the Consumer Discretionary and Energy sectors. Meanwhile, the Utilities and Real Estate sectors gained the most this week, with increases of 4.33% and 2.98%, respectively.

XLC - Communication Services,

XLK - Technology,

XLP - Consumer Staples,

XLE - Energy,

XLY - Consumer Discretionary,

XLF - Financials,

XLI - Industrials,

XLB - Materials,

XLV - Health Care,

XLU - Utilities,

XLRE - Real Estate,

SPY - S&P 500.

The Communication Services sector remains the leader in 2024, with a 17.29% gain. The Utilities and Financial sectors are second and third, respectively. The Consumer Discretionary sector has performed the worst this year, losing 0.56%.

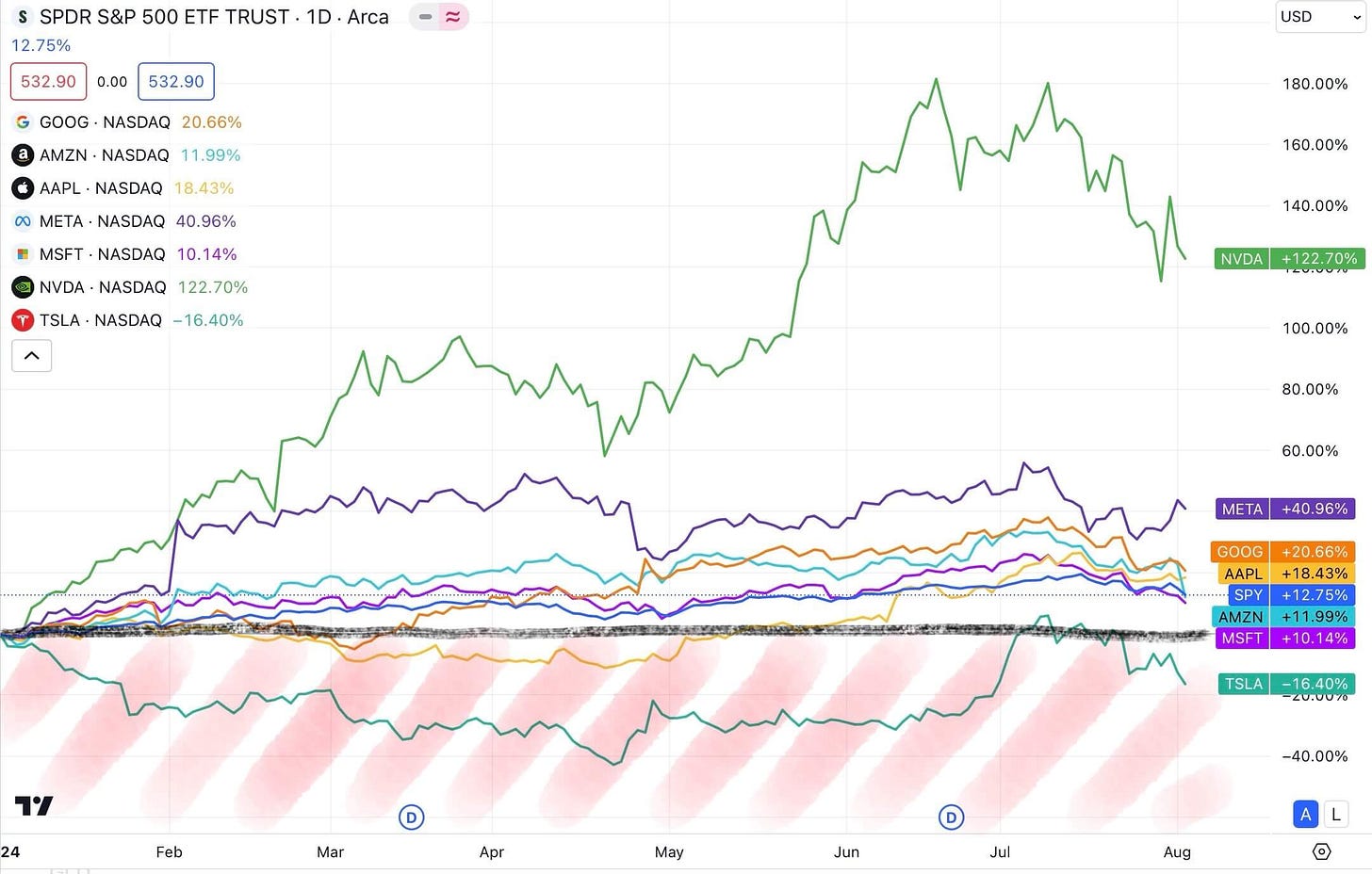

3. The “Magnificent Seven”

The Magnificent Seven stocks were almost all down this week, except for Meta Platforms (META) and Apple Inc. (AAPL). Tesla (TSLA) lost the most at 8.87%, followed by Amazon.com (AMZN), which decreased by 8.69%.

However, all of these stocks are up this year except for Tesla (TSLA), with Nvidia (NVDA) being the clear leader with a 122.70% gain in 2024 so far.

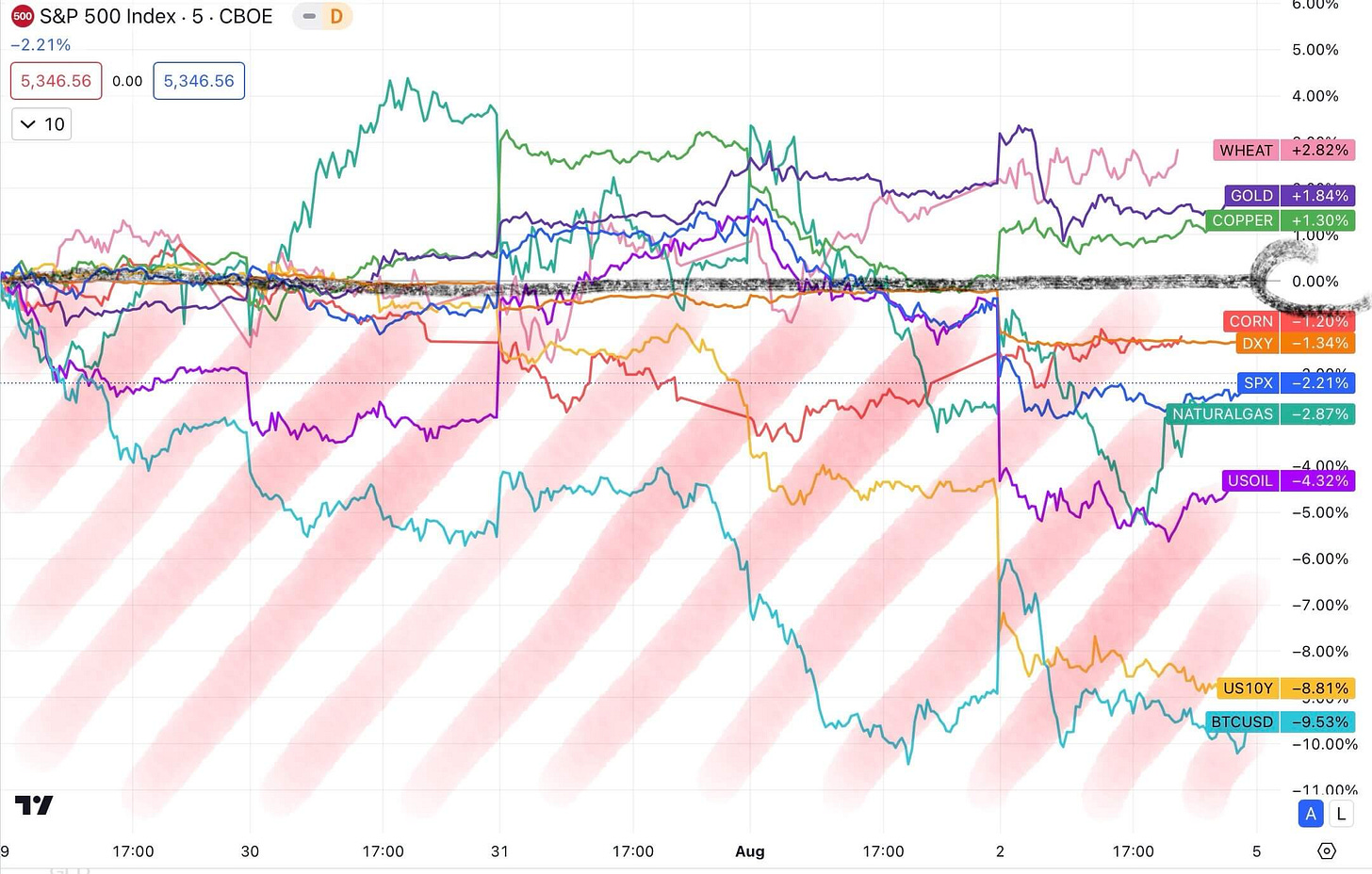

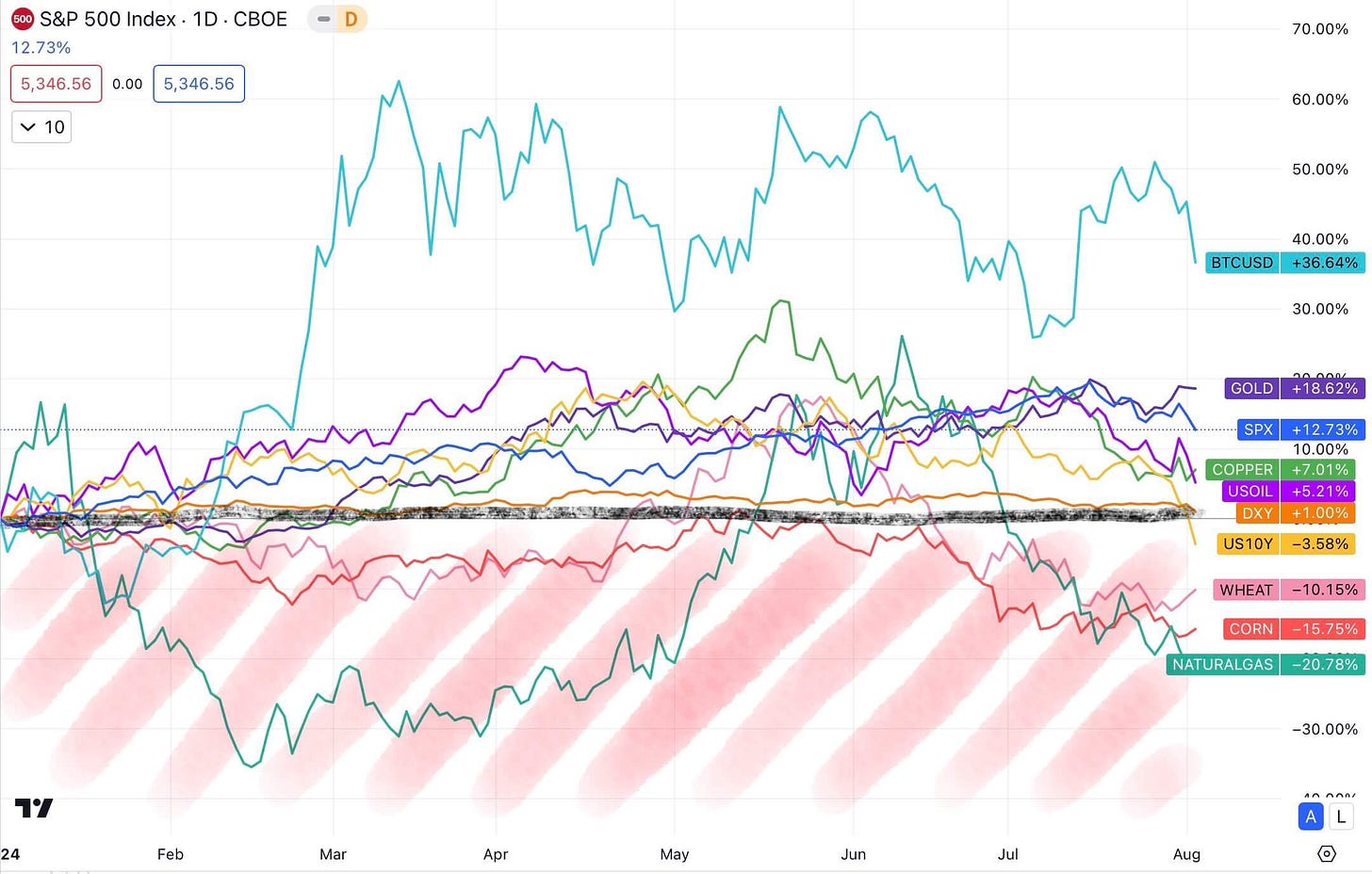

4. Asset Class Rotation (Stocks, Currencies, Commodities, Bonds)

Bitcoin saw the biggest drop this week, losing 9.53%, followed by Oil and Natural Gas. In contrast, Wheat gained 2.82%, and Gold added 1.84%.

Wheat, Corn, and Natural Gas are down this year, while stocks, metals, and Bitcoin are up.

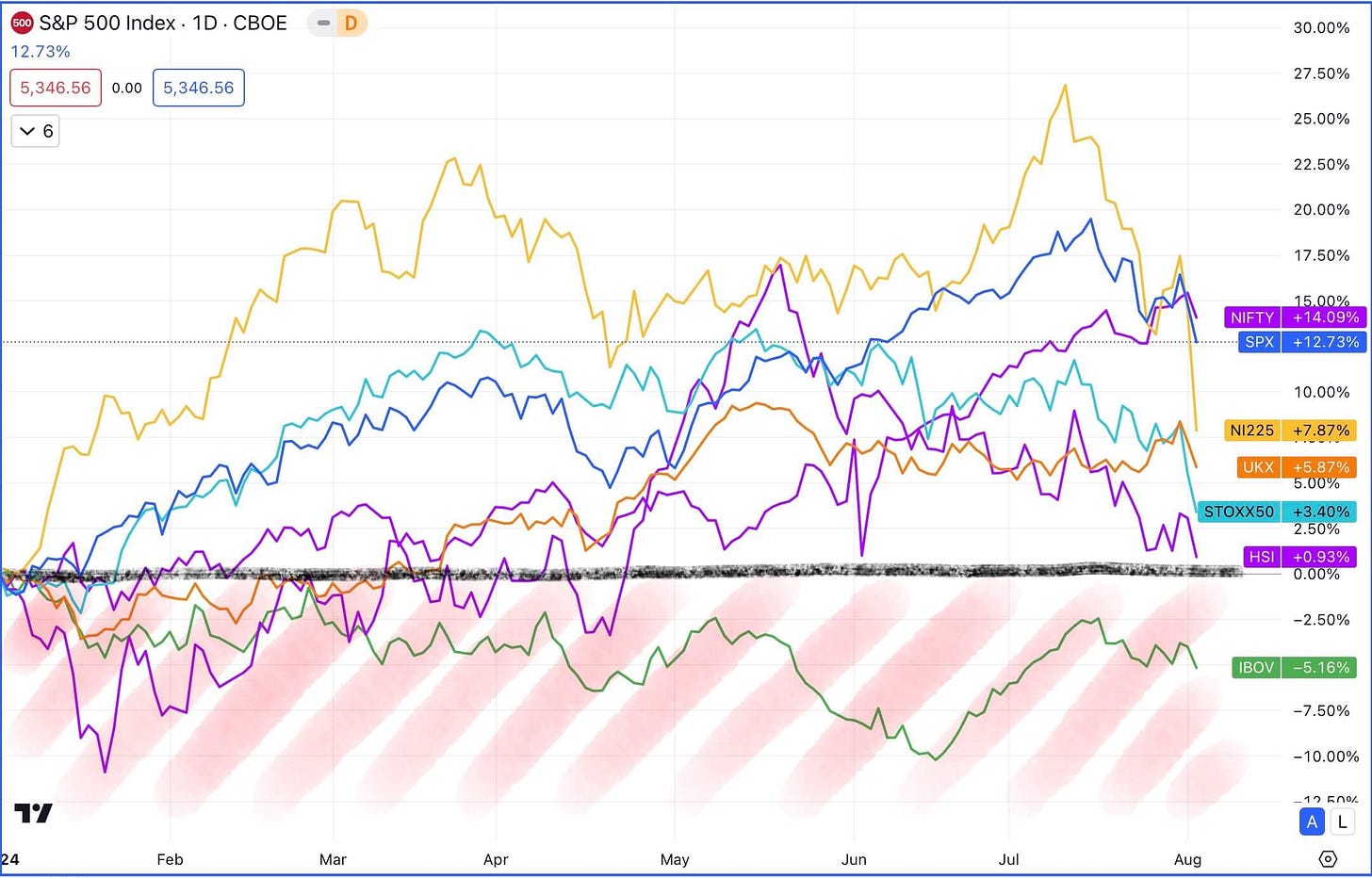

5. Global Stock Markets

Global stocks were also down this week, with Japan and Europe losing the most. India remained almost unchanged.

USA (SPX) - S&P500 Index,

UK (UKX) - FTSE100 Index,

Europe (STOXX50) - EURO STOXX 50 Index,

Japan (NI225) - Nikkei225 Index,

China (HSI) - Hang Seng Index,

India (NIFTY) - Nifty50 Index,

Brazil (IBOV) - BOVESPA Index.

India and the US have gained the most in 2024 so far, while the Brazilian BOVESPA has lost 5.16% this year.

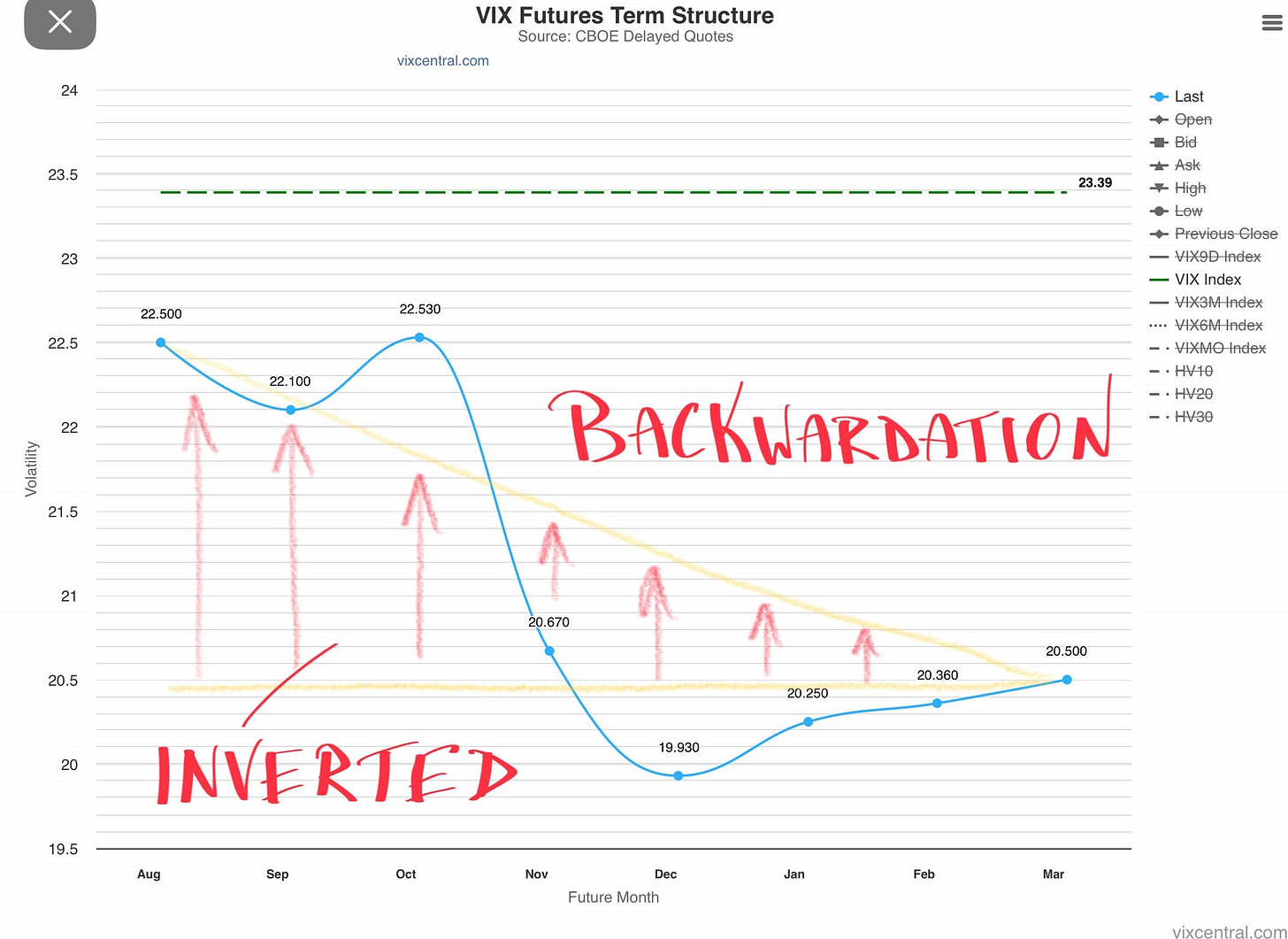

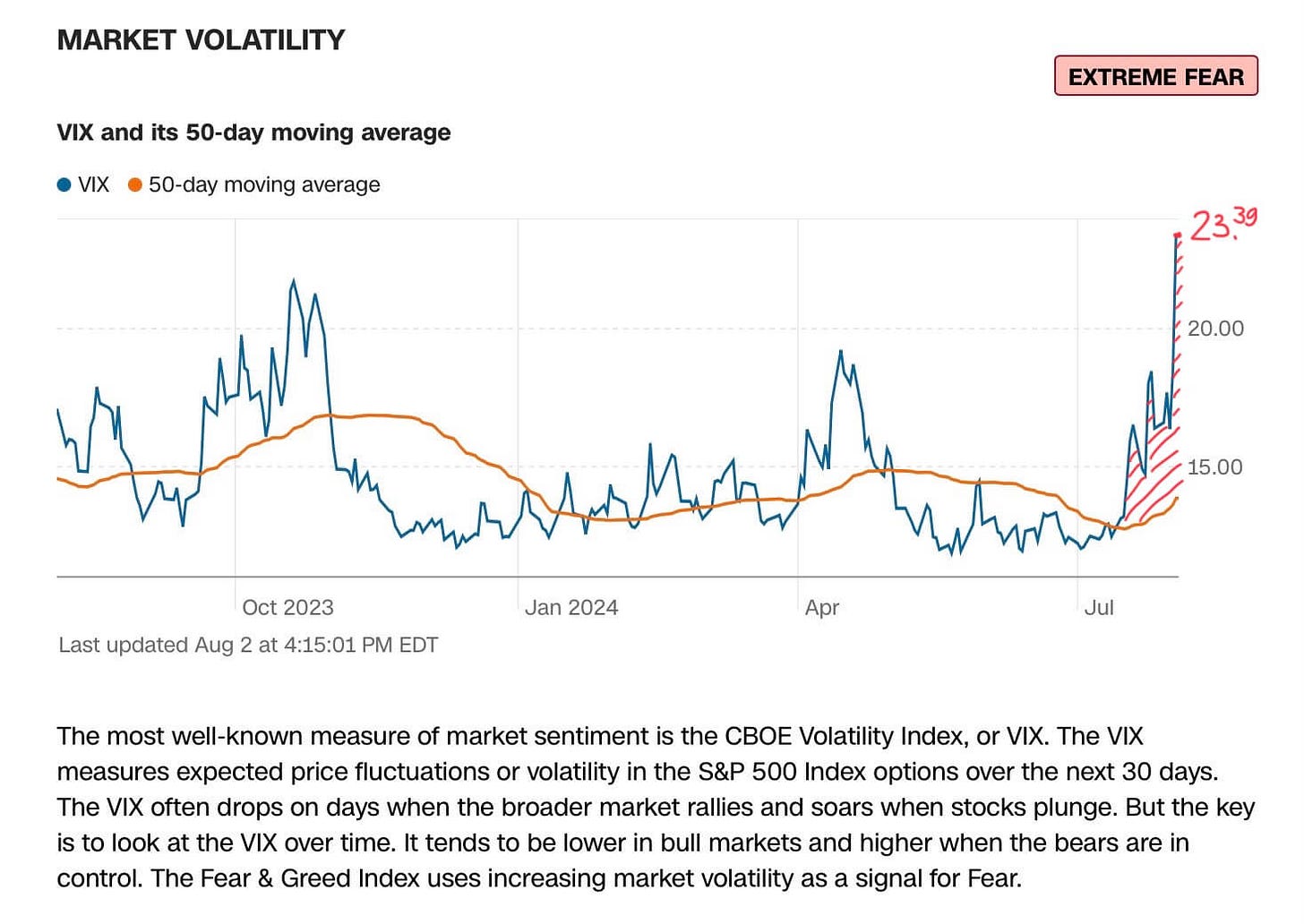

6. Volatility

The VIX futures term structure inverted this week and is now in backwardation, indicating that more volatility is expected in the coming months.

The VIX index closed above 23 this week, signaling that fear has returned to the market.

The Volatility of Volatility Index (VVIX) shows an increase in demand for VIX index products, indicating that market participants were willing to pay more for hedging products.

“The SKEW index measures tail risk—returns two or more standard deviations from the mean—in S&P 500 returns over the next 30 days. The primary difference between the VIX and the SKEW is that the VIX is based on implied volatility around the at-the-money (ATM) strike price, while the SKEW considers implied volatility of out-of-the-money (OTM) strikes.” (more at Investopedia.com)

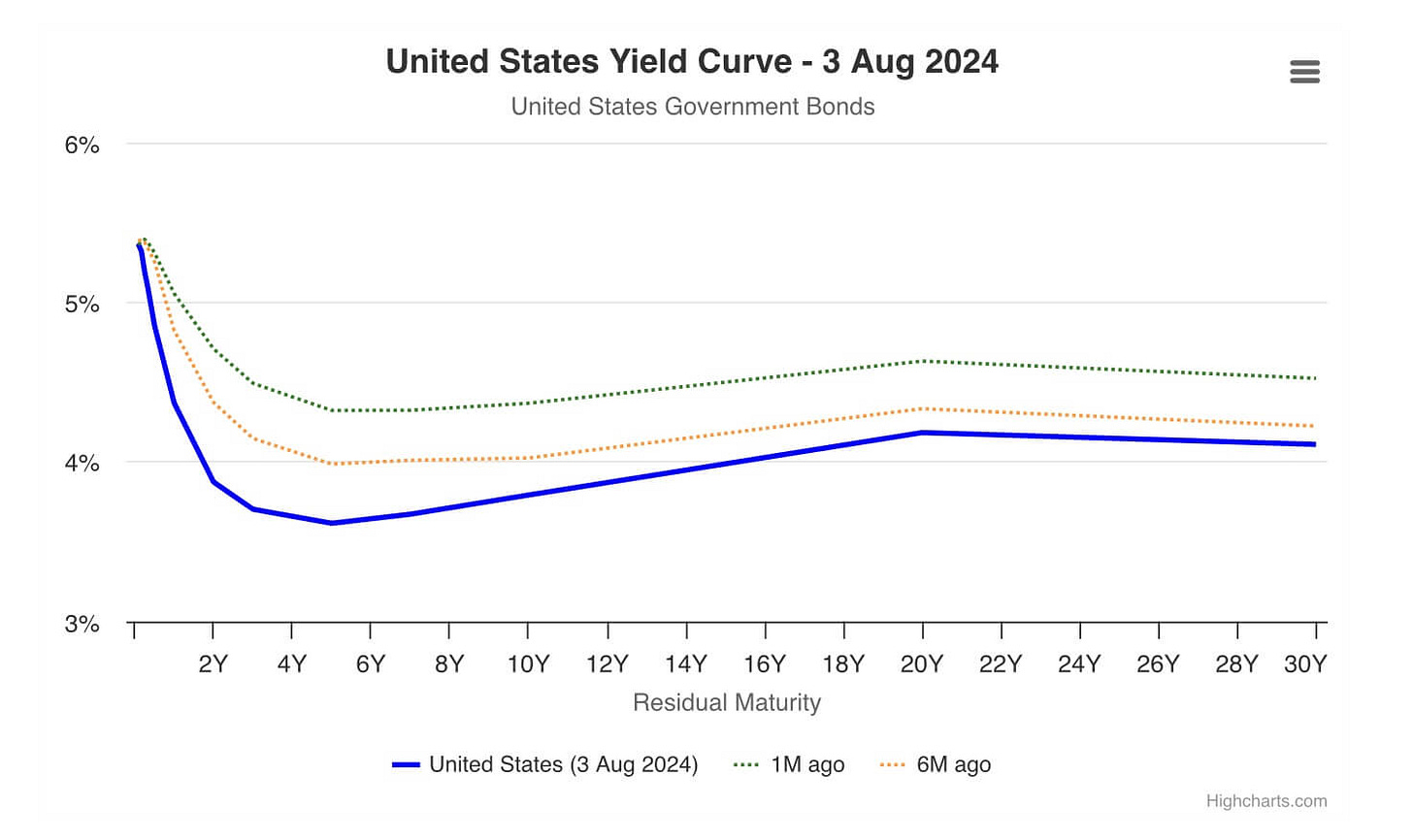

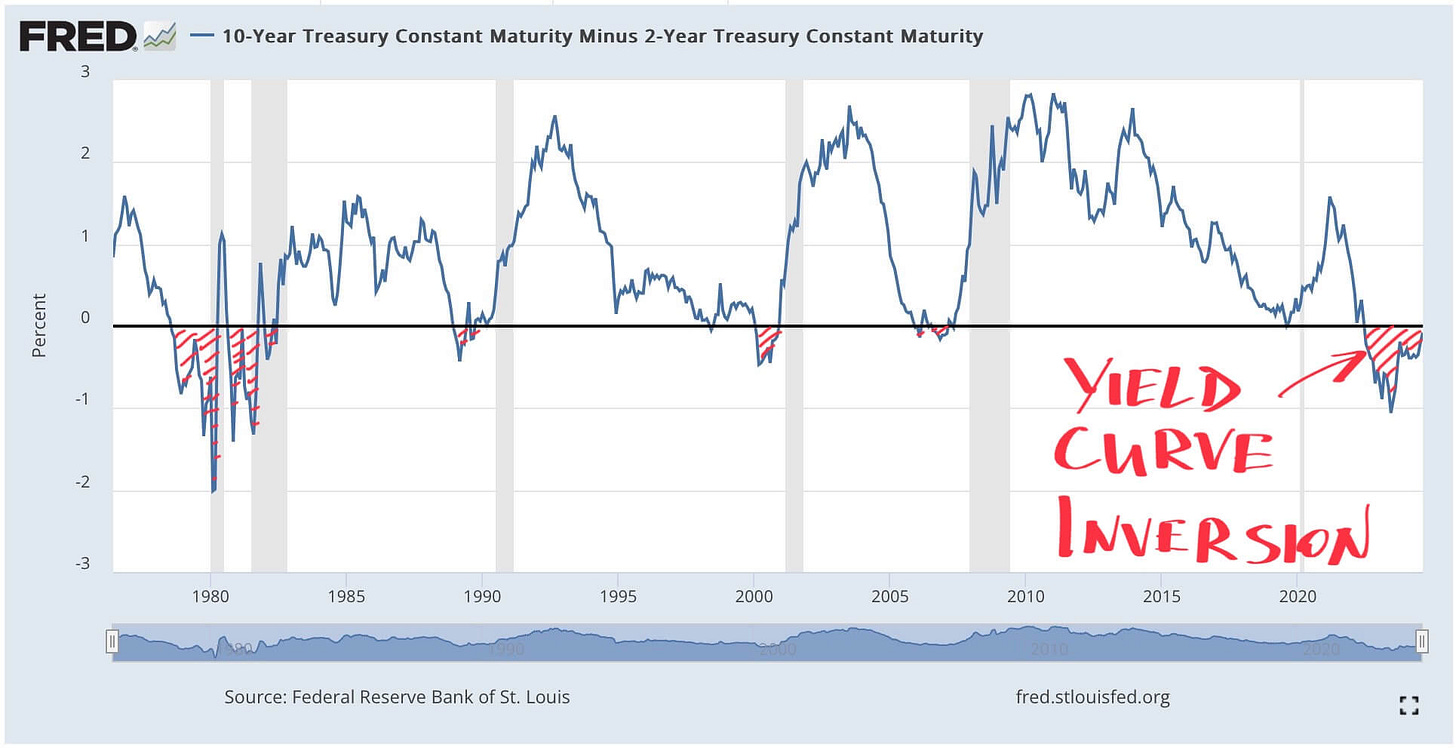

7. US Treasuries

The US Treasuries Yield Curve remains inverted, suggesting a possible recession in the future.

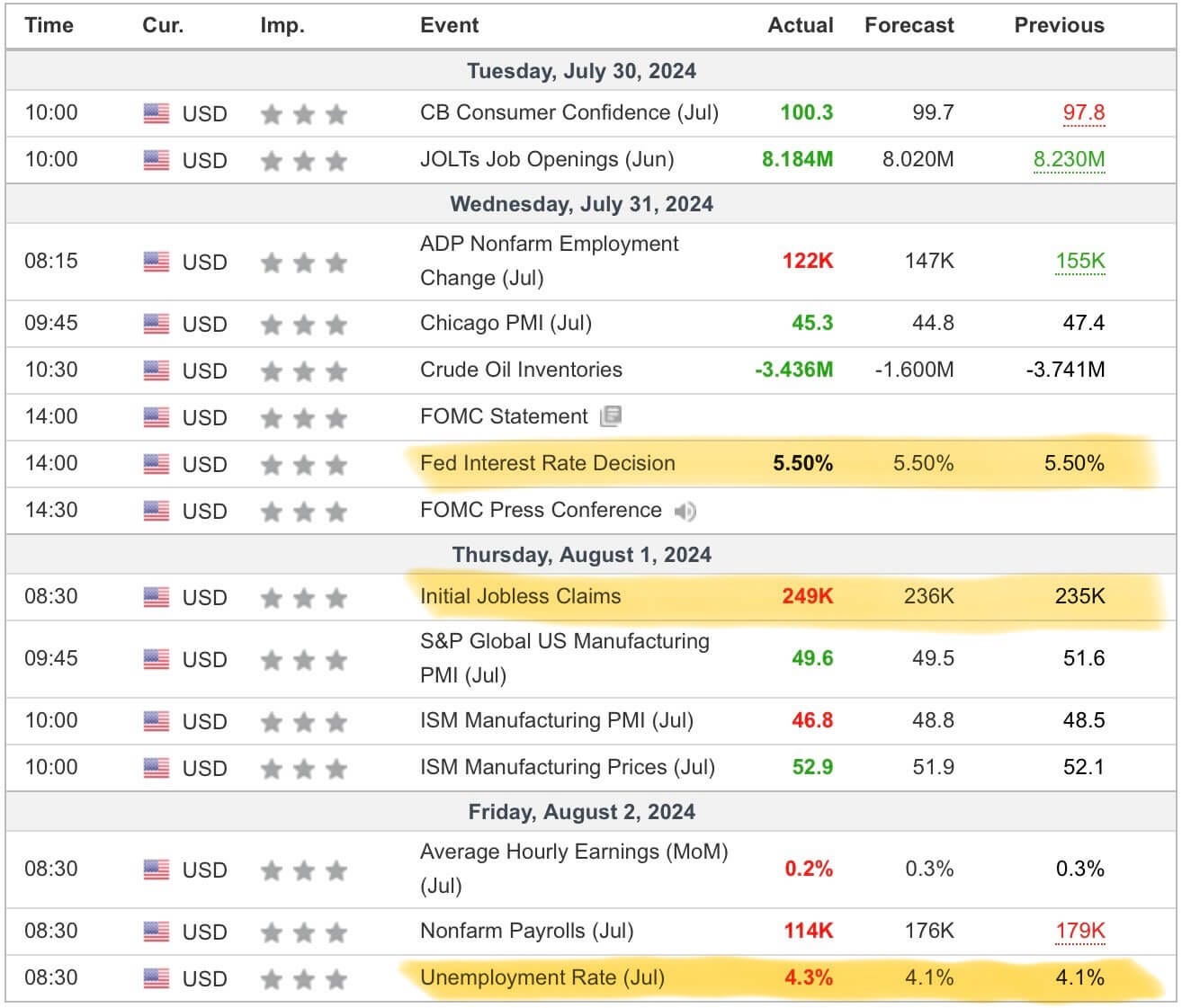

8. Major Economic Announcements

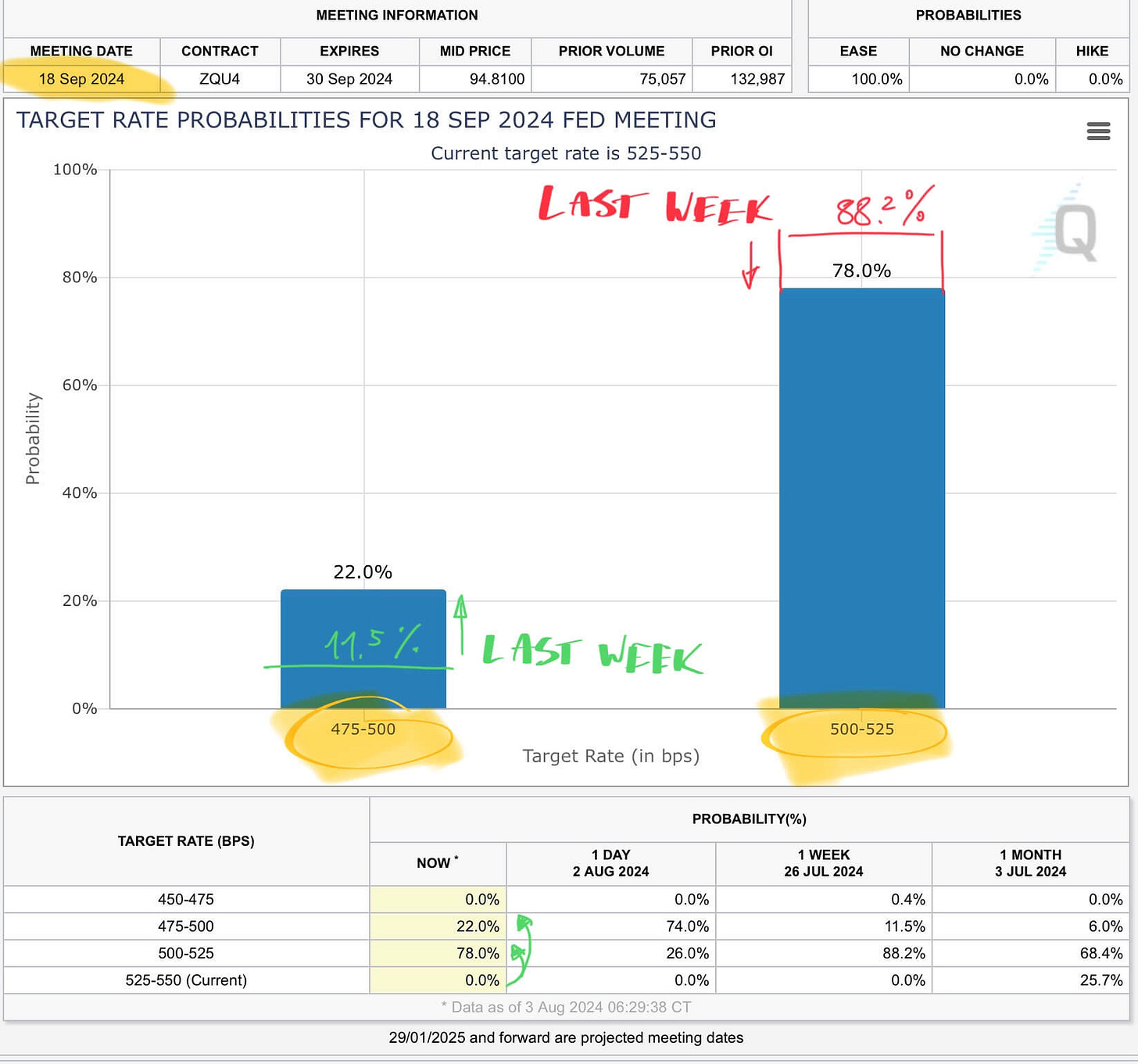

The Federal Reserve left interest rates unchanged this week but signaled a possible raise in September. Initial Jobless Claims and the Unemployment Rate suggest that the economy might not be performing as well as previously expected, increasing the likelihood of a recession in the near future.

According to the CME FedWatch Tool, there is a 78% probability that the Fed will cut interest rates by 25 basis points and a 22% probability of a 50 basis points cut during the September meeting.

9. Earnings Reports

McDonald’s (MCD) was the largest company to report earnings on Monday.

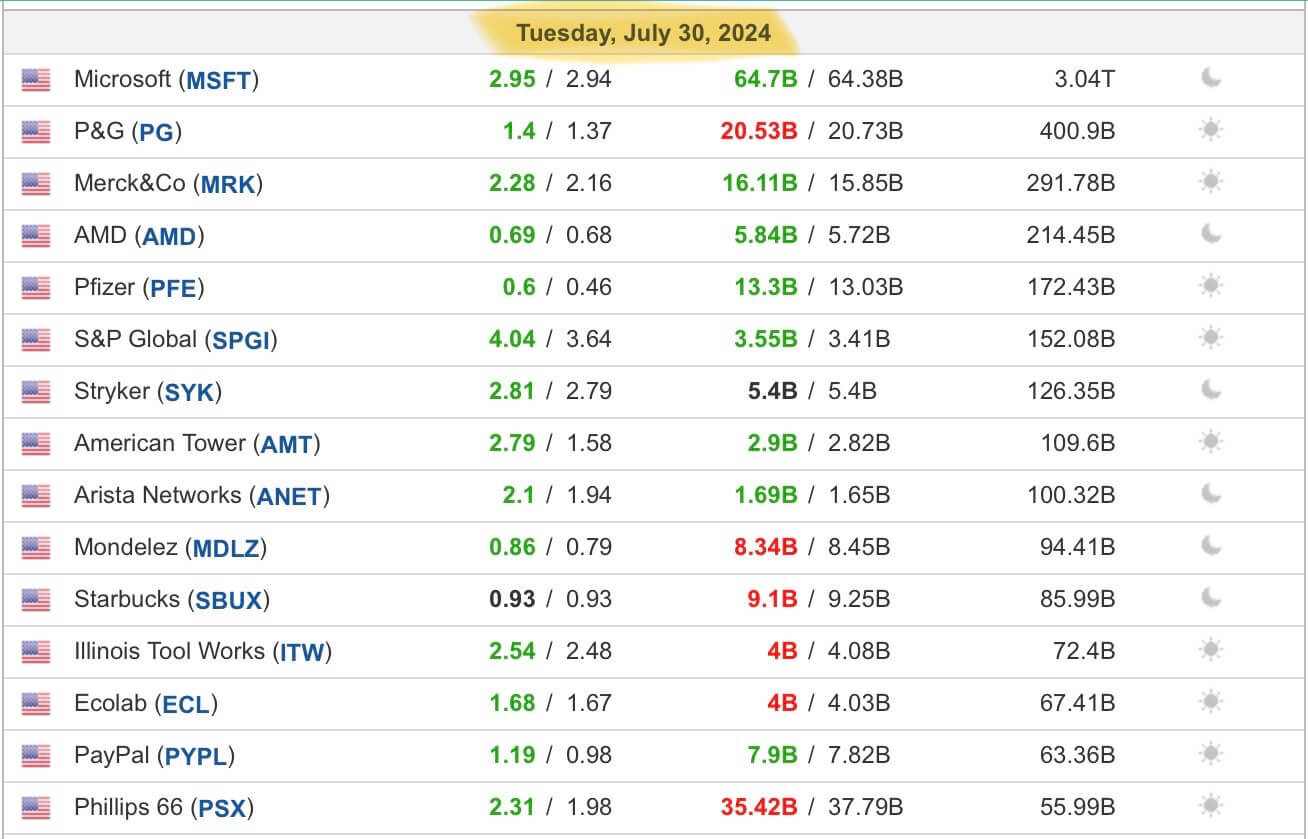

Microsoft (MSFT), Procter & Gamble (PG), and others reported earnings on Tuesday.

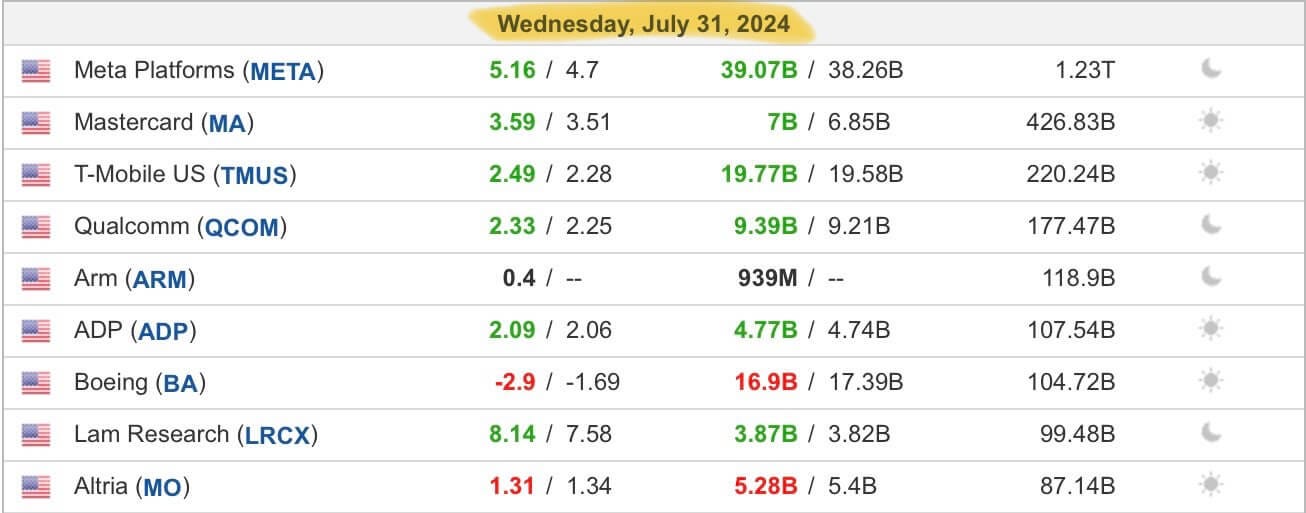

Meta Platforms and Mastercard reported on Wednesday and exceeded investors’ expectations.

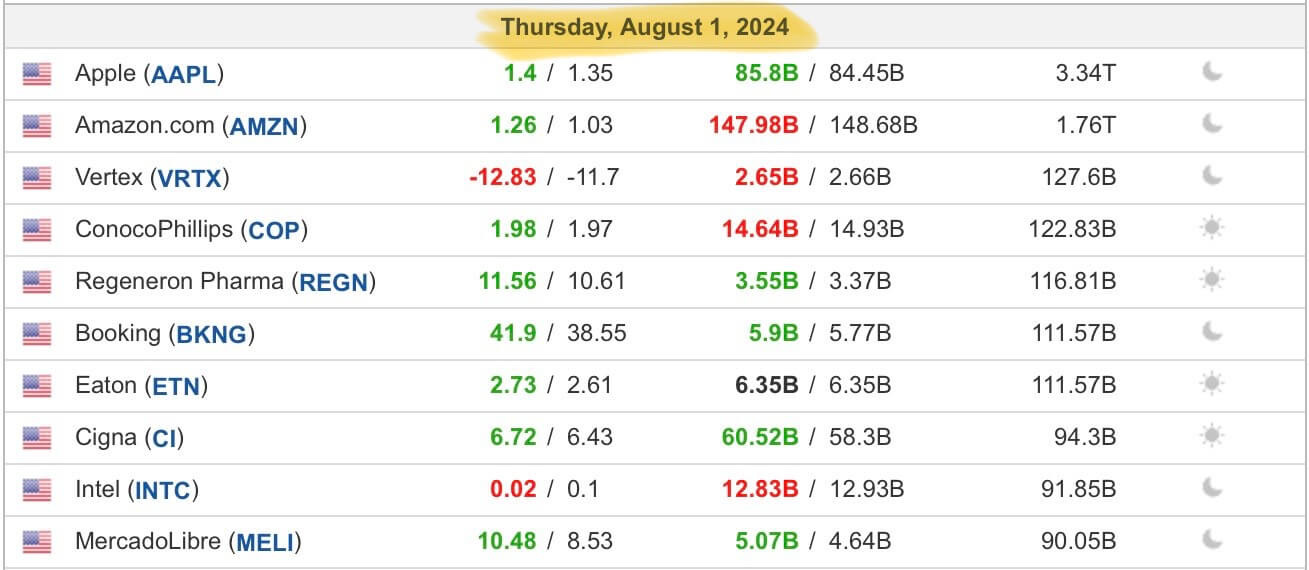

Thursday was a big day, with Apple (AAPL) and Amazon.com (AMZN) reporting earnings after the market closed. Amazon.com disappointed investors, leading to a decrease in its share price on Friday.

Oil giants Exxon Mobil (XOM) and Chevron (CVX) reported earnings on Friday.

Next Week

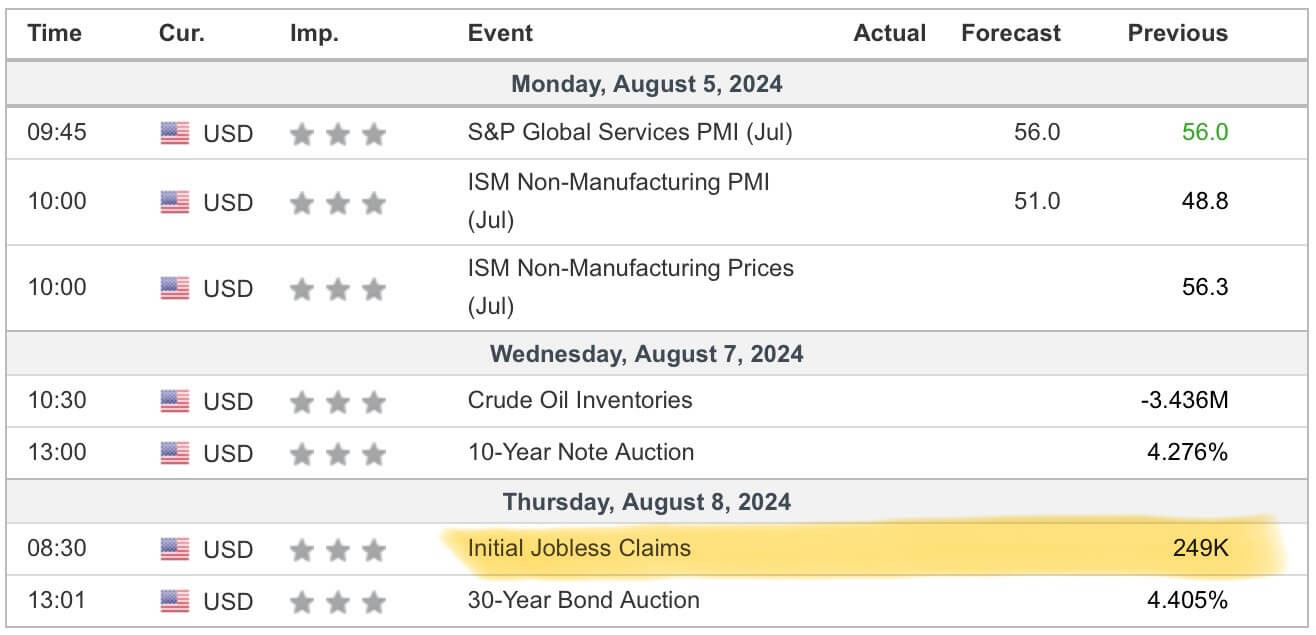

1. Major Economic Announcements

Next week, we will focus on the Initial Jobless Claims coming out on Thursday.

2. Earnings Reports

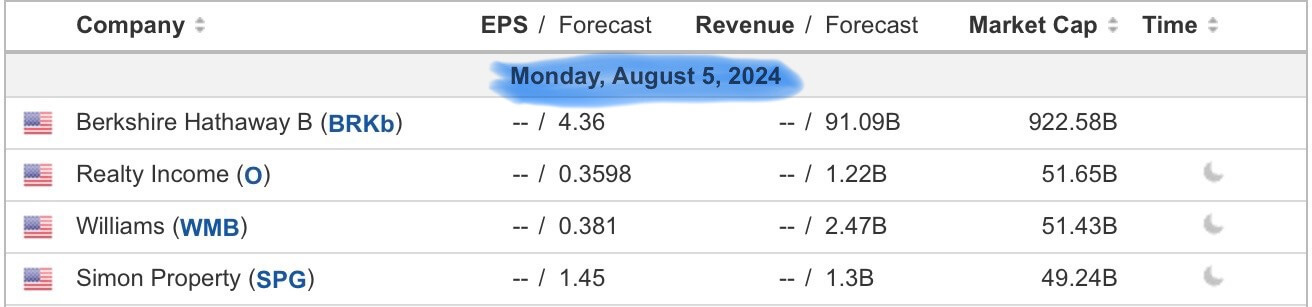

Berkshire Hathaway (BRK.B) is the largest company to report earnings on Monday.

Tuesday will see Amgen, Caterpillar, and Uber Technologies reporting their earnings.

Walt Disney will report on Wednesday.

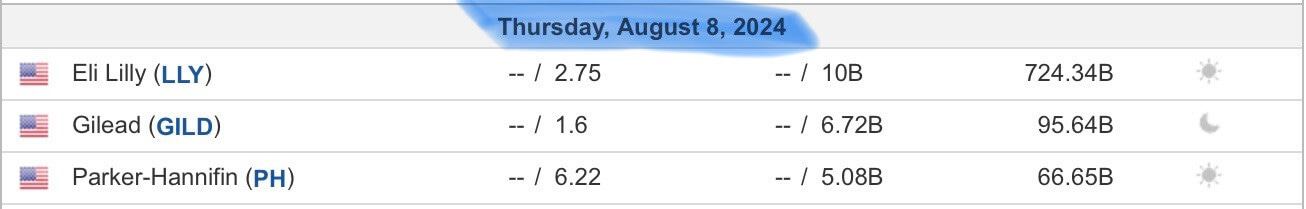

Eli Lilly will report its earnings on Thursday.

3. Expected Move

The options market anticipates that the S&P 500 is likely to move +/- 2.2% next week.

Happy trading and investing! 🤑📊🚀

The next email will be sent on Sunday (11 Aug 2024).