📈 Week 29 (15-21 July 2024) Market Summary

US Stocks (Major Indices), Sector and Asset Class rotation, The Magnificent Seven, Global Stock Indices, Volatility, Major Economics Announcements and Earnings Reports

Hello! 👋

Let's take a look at what we've been up to this week.

1. US Stocks (Major Indices)

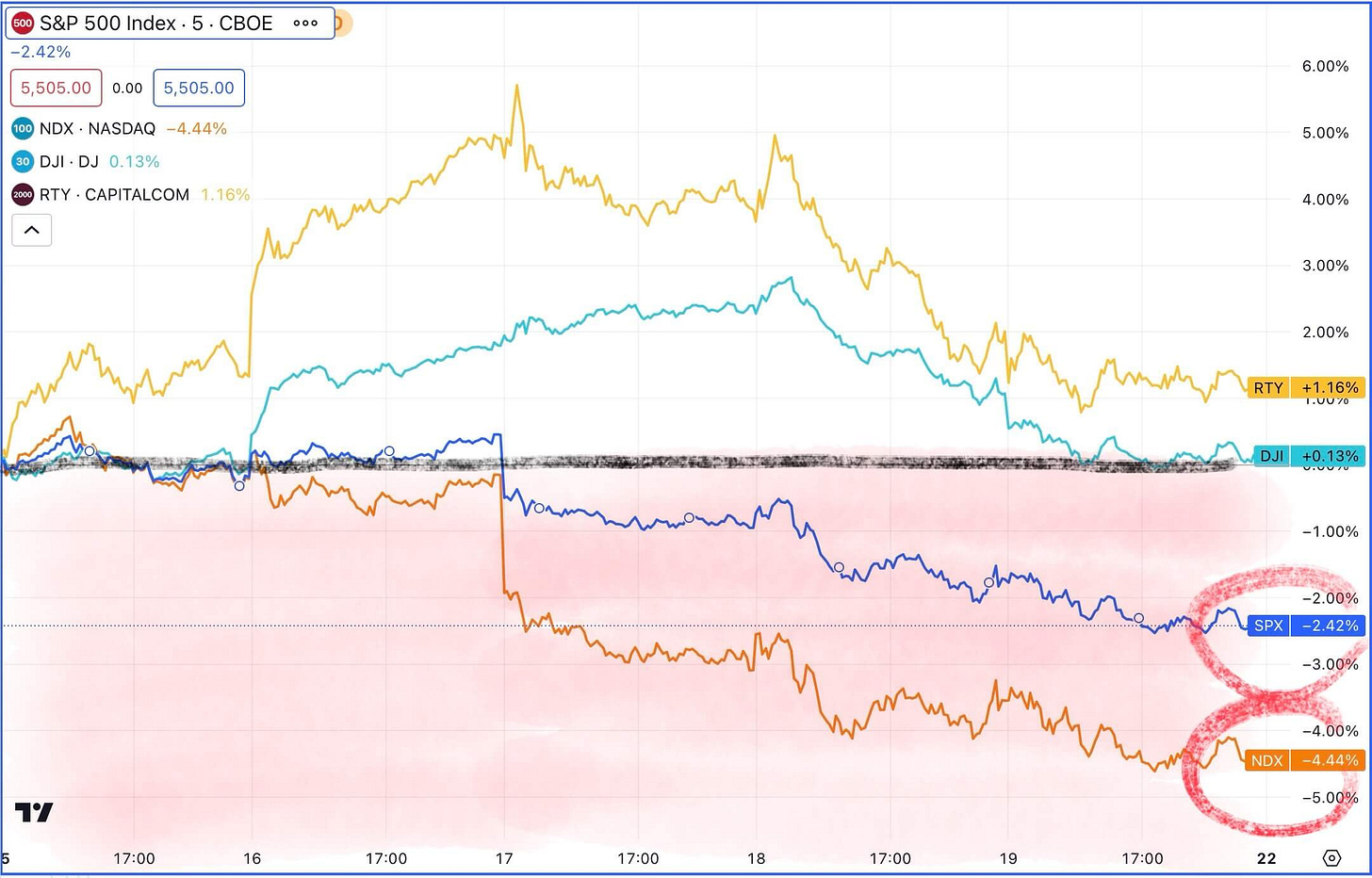

US stocks ended the week in the red. We observed that tech stocks were on sale, with capital rotating into other sectors such as Financials, Healthcare, and Energy.

The Nasdaq 100 lost the most (-4.44%) among the major US stock indices. The S&P 500 decreased by 2.42%, the Dow Jones Industrial Average remained almost unchanged, and the Russell 2000 even increased by 1.16%.

However, the Nasdaq 100 is still a leader in 2024, having increased by 18.00% this year. The S&P 500 has risen by 16.07%, the Russell 2000 has added 8.53%, and the Dow Jones (DJIA) has grown by 6.82% so far this year.

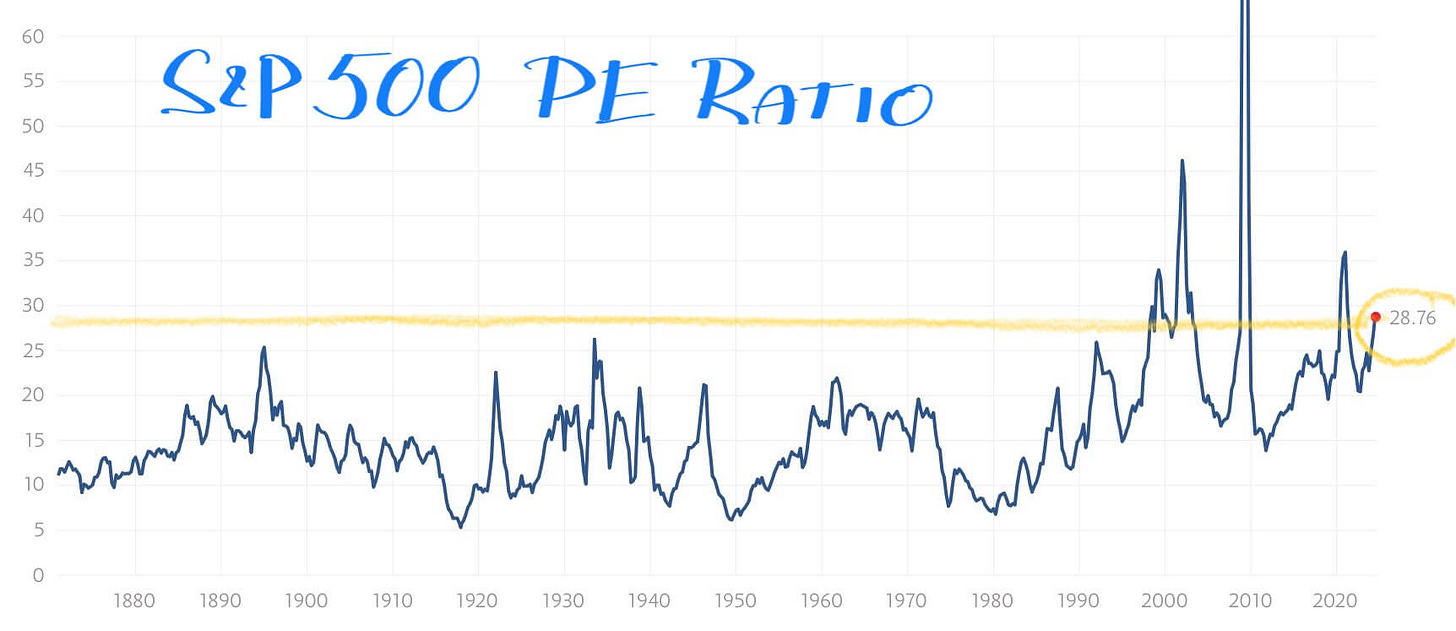

The Price/Earnings Ratio of S&P 500 index companies is currently at 28.76, which is high but not extreme.

2. US Stocks by Sector

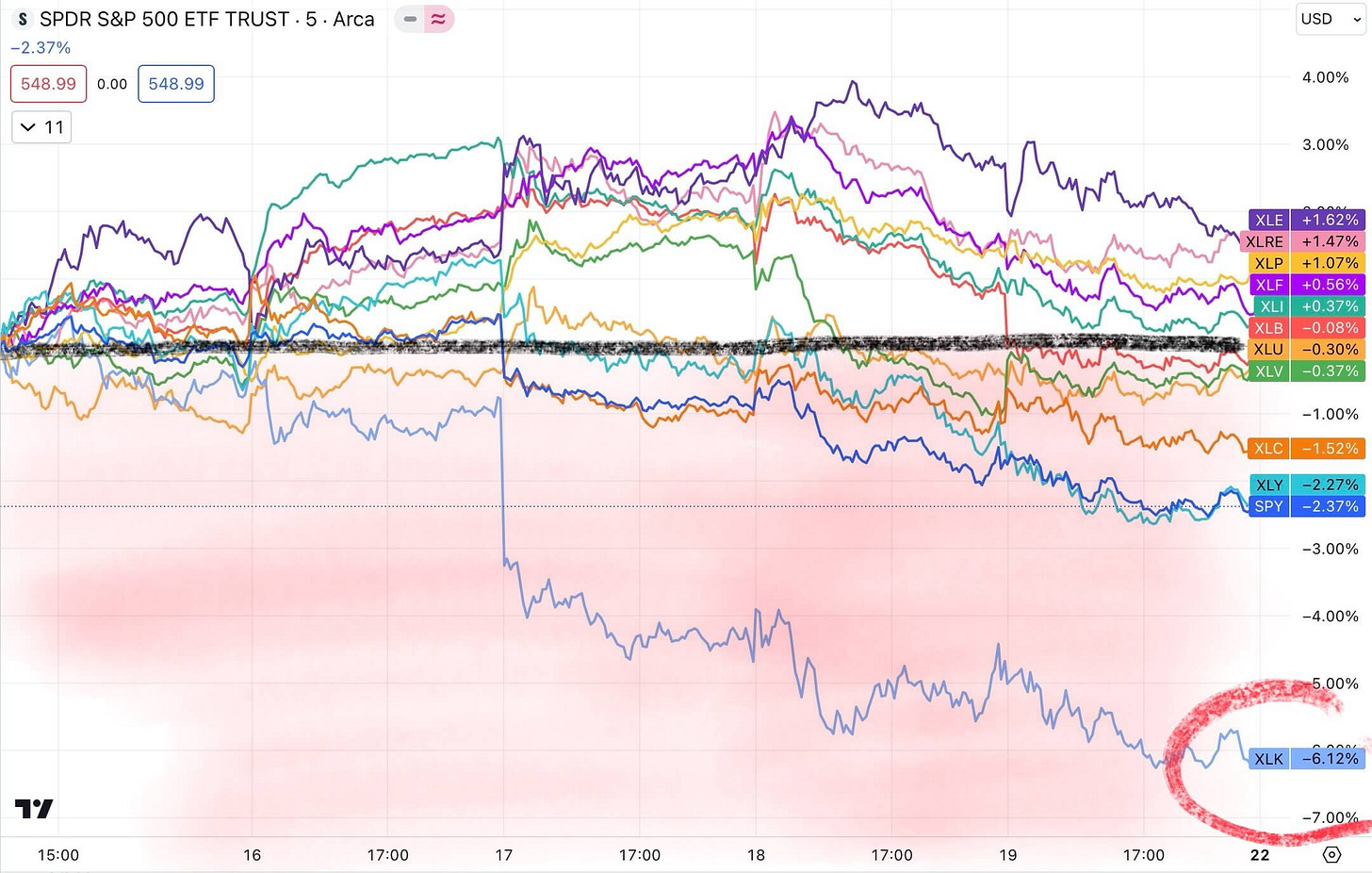

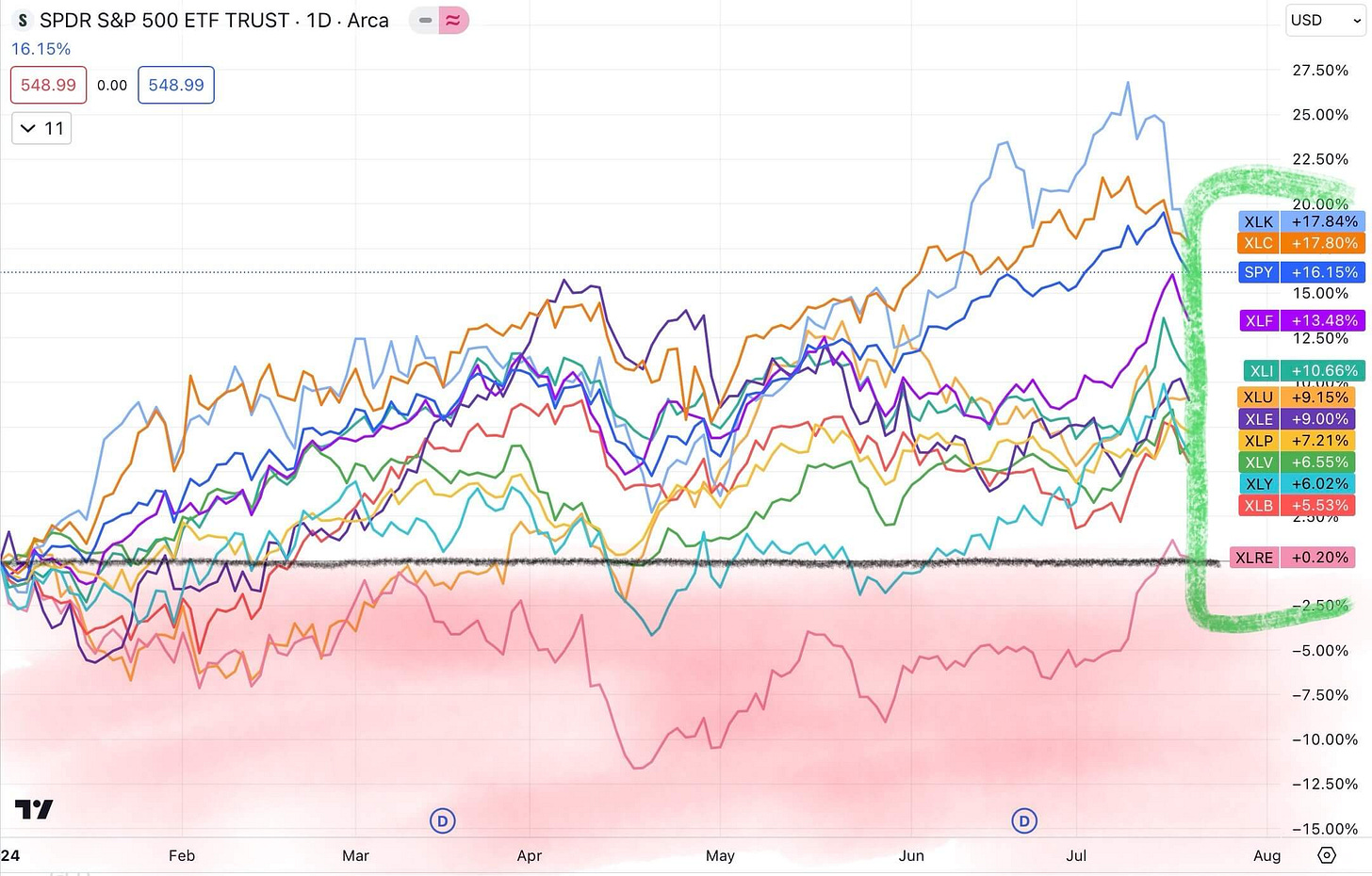

The Technology sector lost the most this week, followed by the Consumer Discretionary and Communication Services sectors. Energy and Real Estate gained the most this week.

XLC - Communication Services,

XLK - Technology,

XLP - Consumer Staples,

XLE - Energy,

XLY - Consumer Discretionary,

XLF - Financials,

XLI - Industrials,

XLB - Materials,

XLV - Health Care,

XLU - Utilities,

XLRE - Real Estate,

SPY - S&P 500.

The Technology sector remains the leader in 2024 with a 17.84% gain. The Communication Services and Financial sectors are second and third, respectively. The Real Estate sector performed the worst this year, gaining only 0.20%.

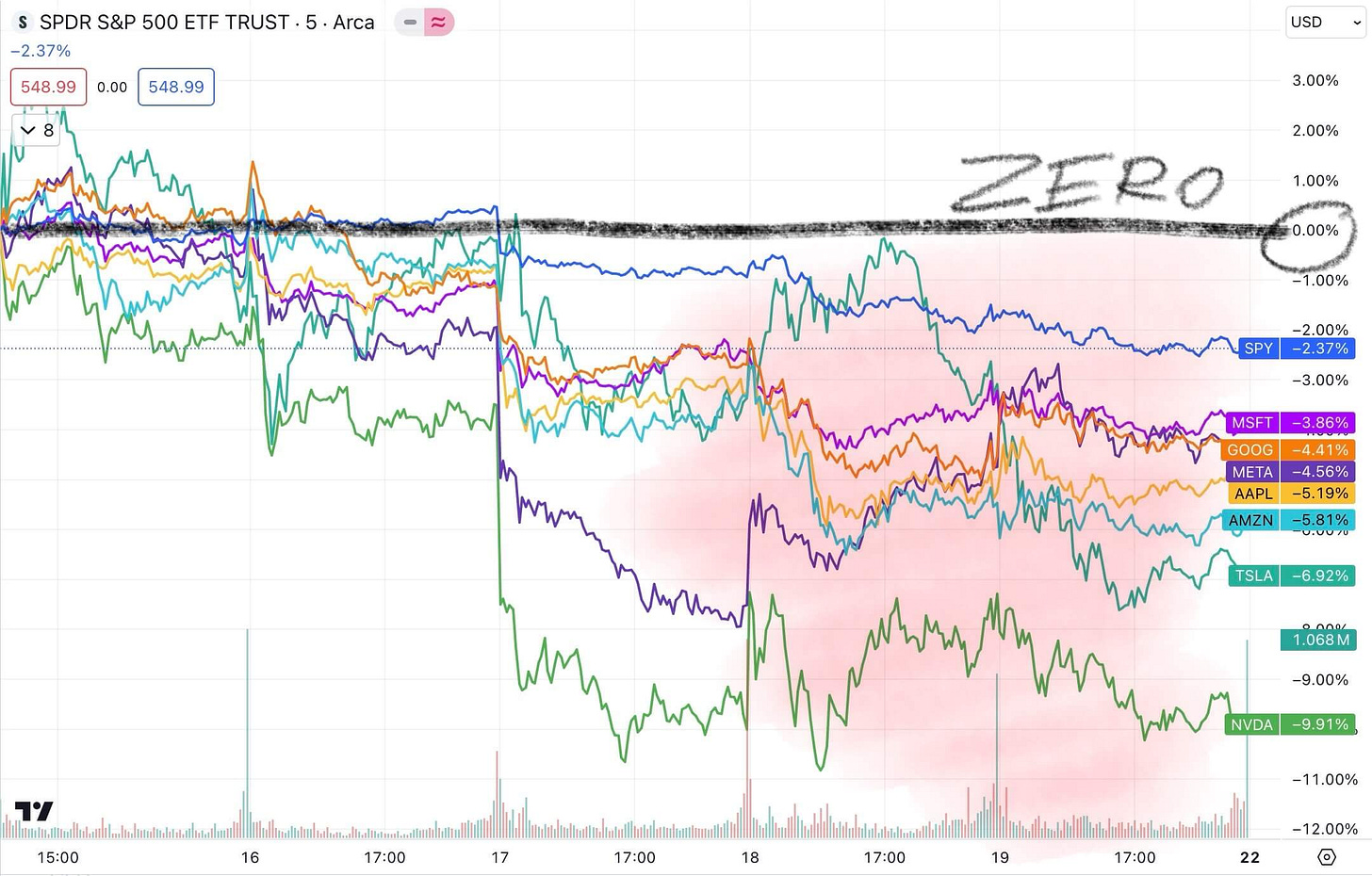

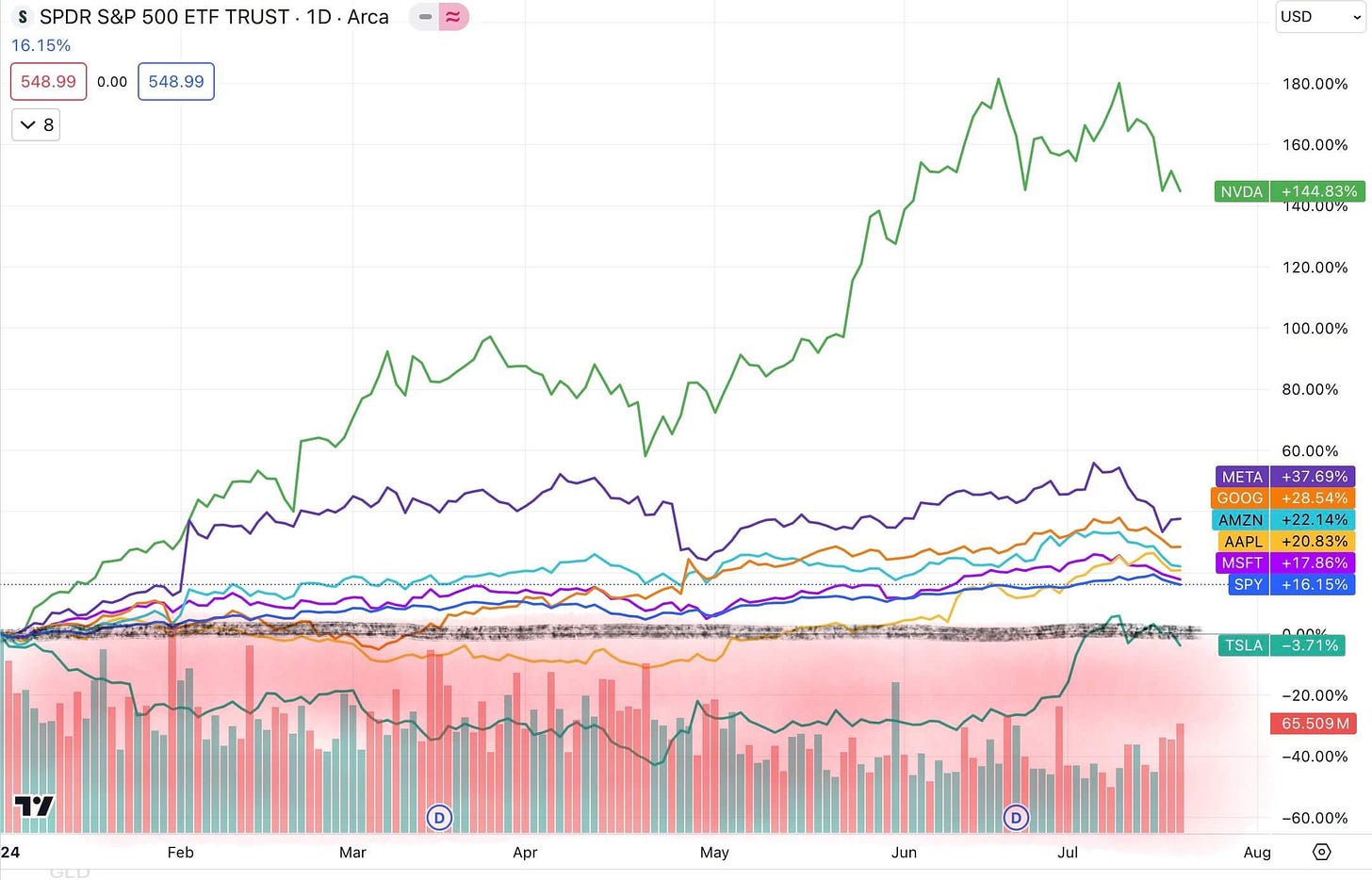

3. The “Magnificent Seven”

The Magnificent Seven stocks were all down this week, with Nvidia losing the most (-9.91%).

However, they are all up this year except for Tesla (TSLA), with Nvidia (NVDA) being the clear leader with a 144.83% gain in 2024 so far.

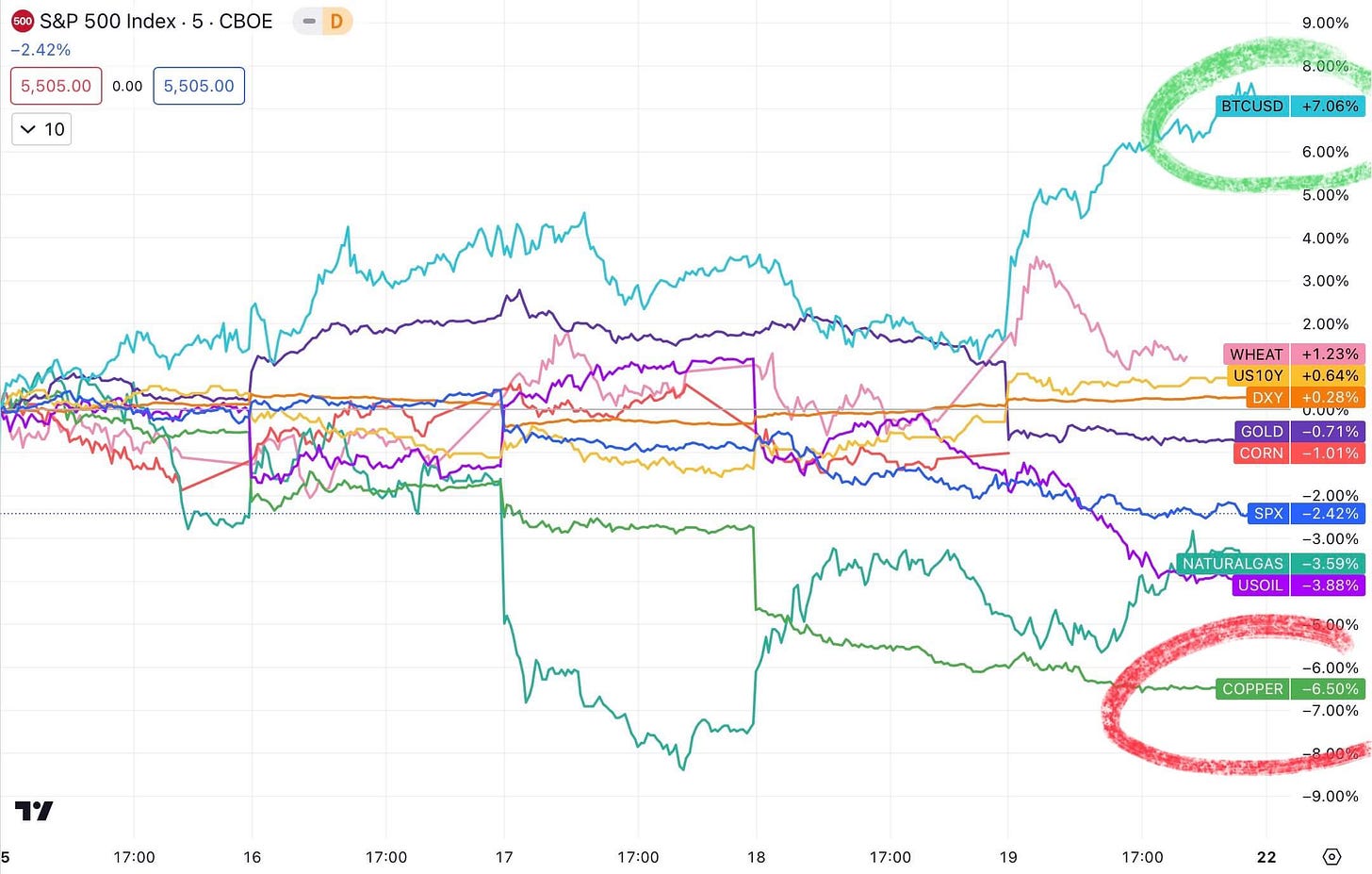

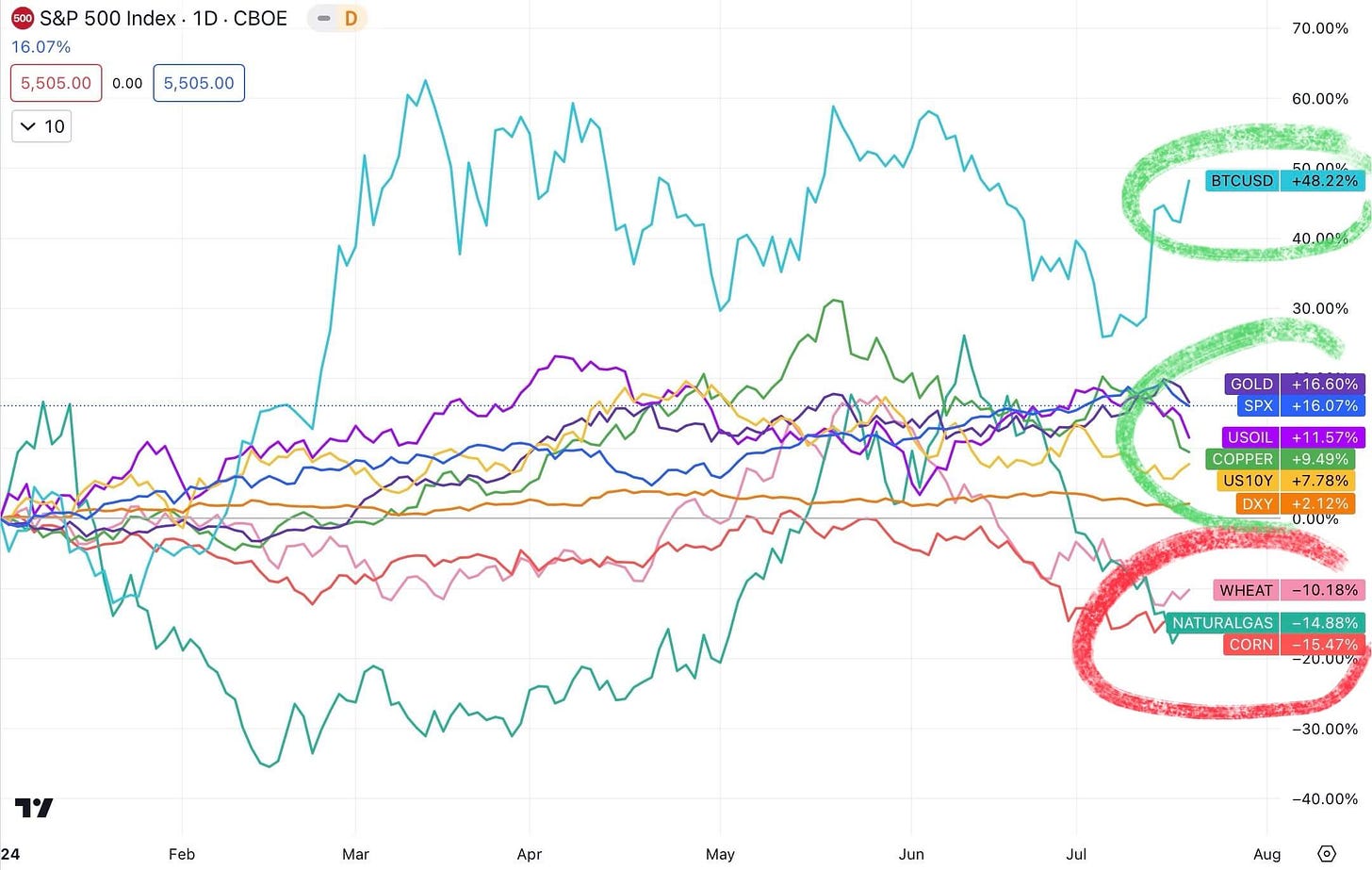

4. Asset Class Rotation (Stocks, Currencies, Commodities, Bonds)

Copper, Oil, and Natural Gas decreased this week, while Bitcoin increased by over 7%.

Wheat, Corn, and Natural Gas are down this year, while stocks, metals, and Bitcoin are up.

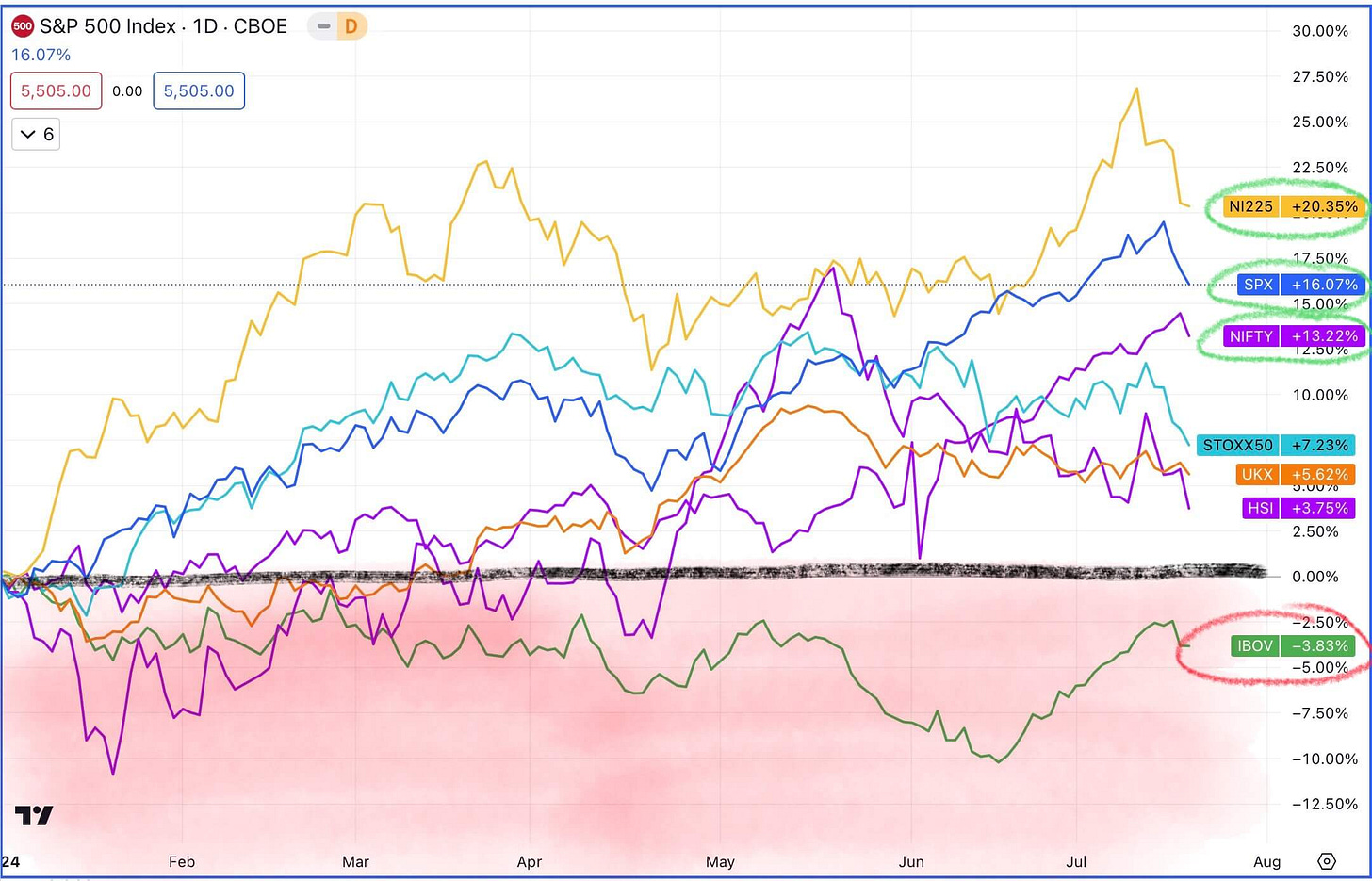

5. Global Stock Markets

Global stocks were also down this week, with Europe and China losing the most. India and the UK remained almost unchanged.

USA (SPX) - S&P500 Index,

UK (UKX) - FTSE100 Index,

Europe (STOXX50) - EURO STOXX 50 Index,

Japan (NI225) - Nikkei225 Index,

China (HSI) - Hang Seng Index,

India (NIFTY) - Nifty50 Index,

Brazil (IBOV) - BOVESPA Index.

Japan and the US have gained the most in 2024 so far, while the Brazilian BOVESPA has lost 3.83% this year.

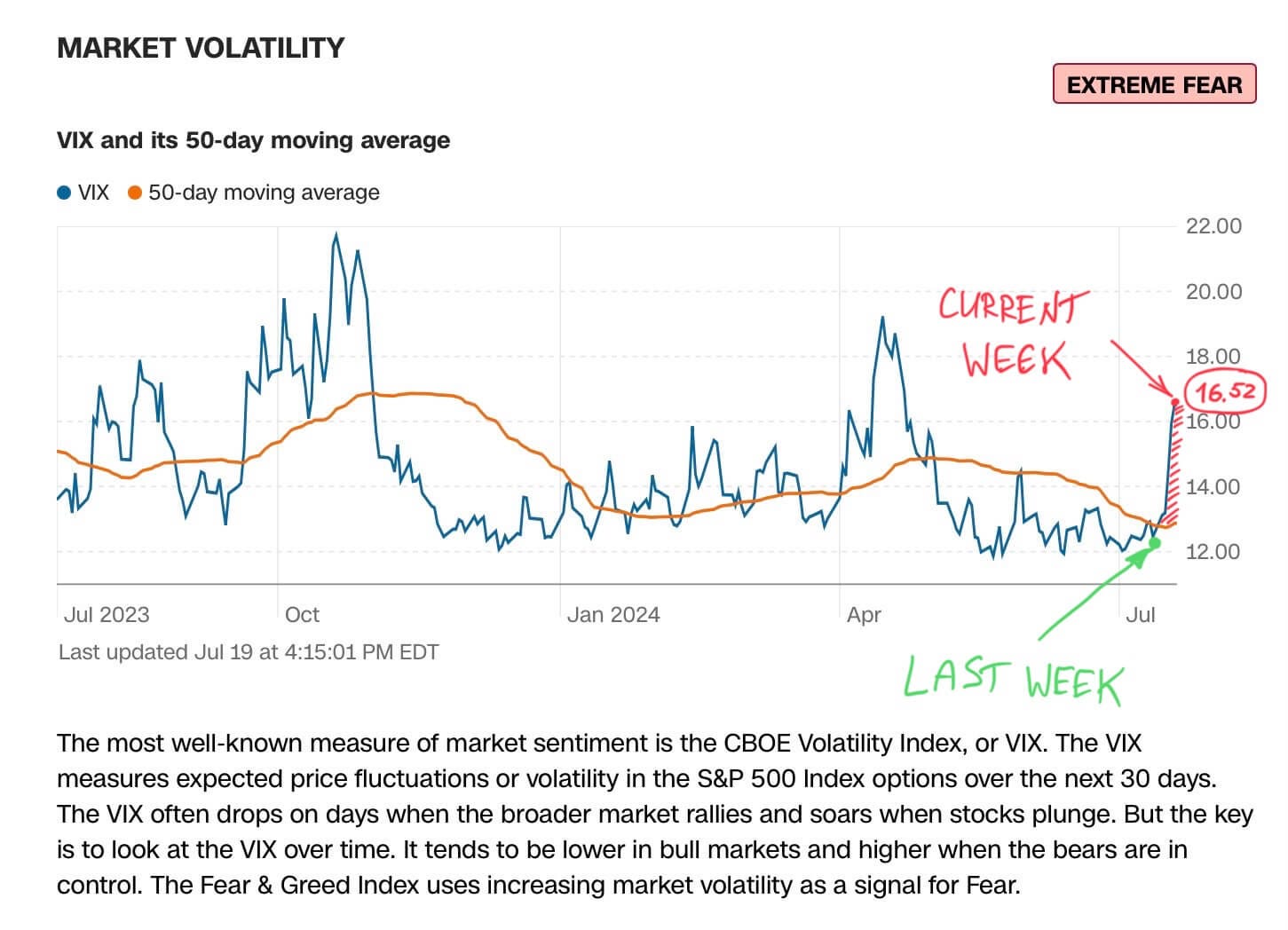

6. Volatility

The VIX futures term structure indicates that there is hedging activity going on around the US Presidential Election.

The VIX index rallied from 12 to 16 this week, indicating that fear has returned to the market.

The Volatility of Volatility Index (VVIX) jumped by 11.17%, showing an increase in demand for VIX index products, meaning that market participants were willing to pay more for hedging products than the week before.

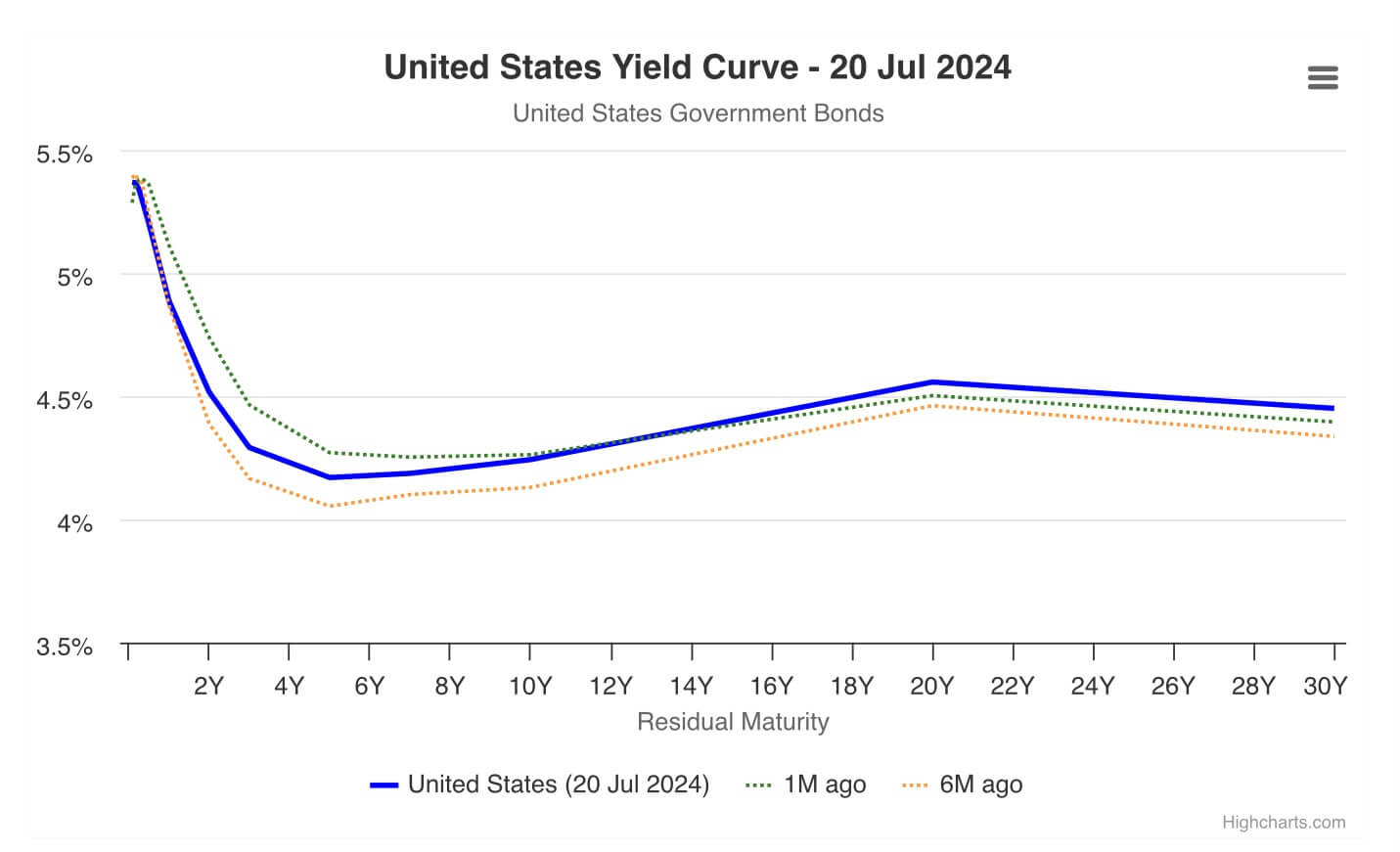

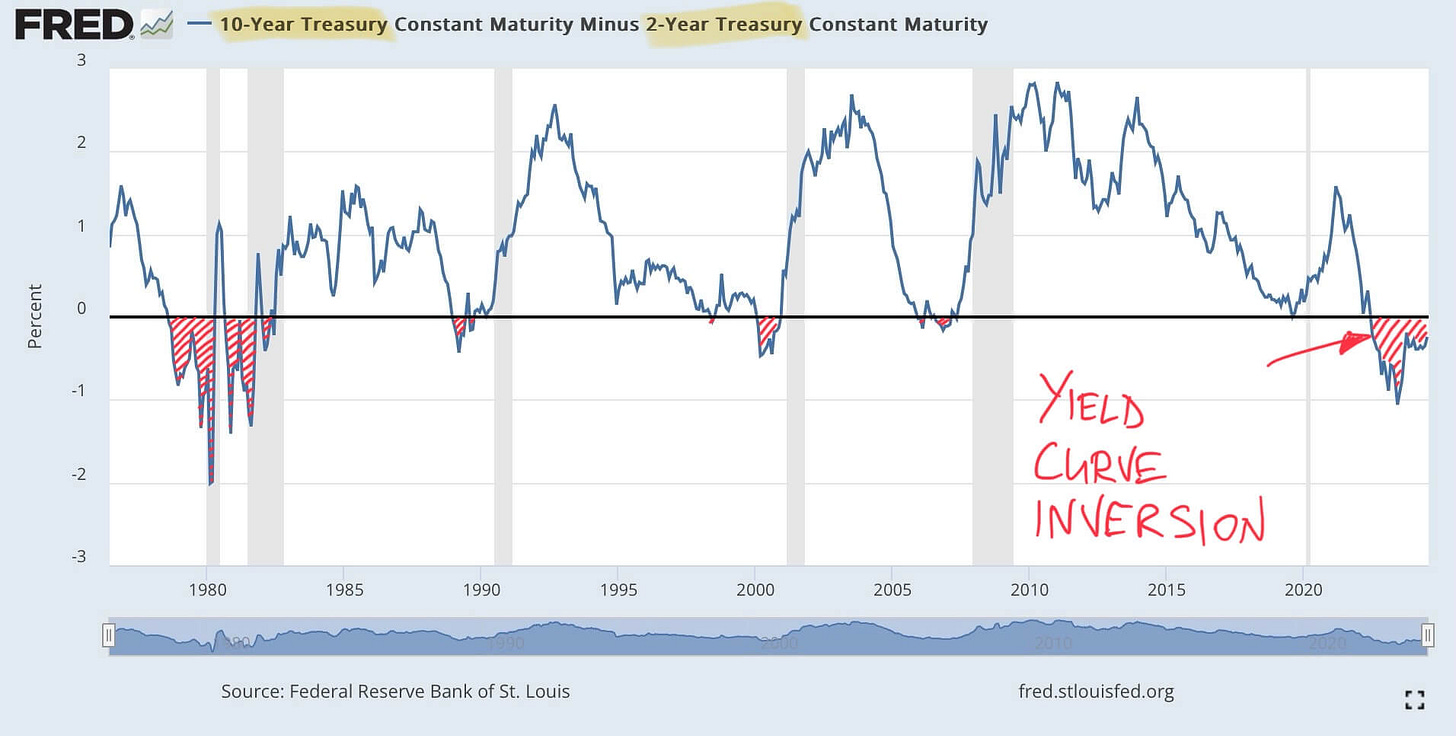

7. US Treasuries

The US Treasuries Yield Curve remains inverted, indicating a possible recession in the future.

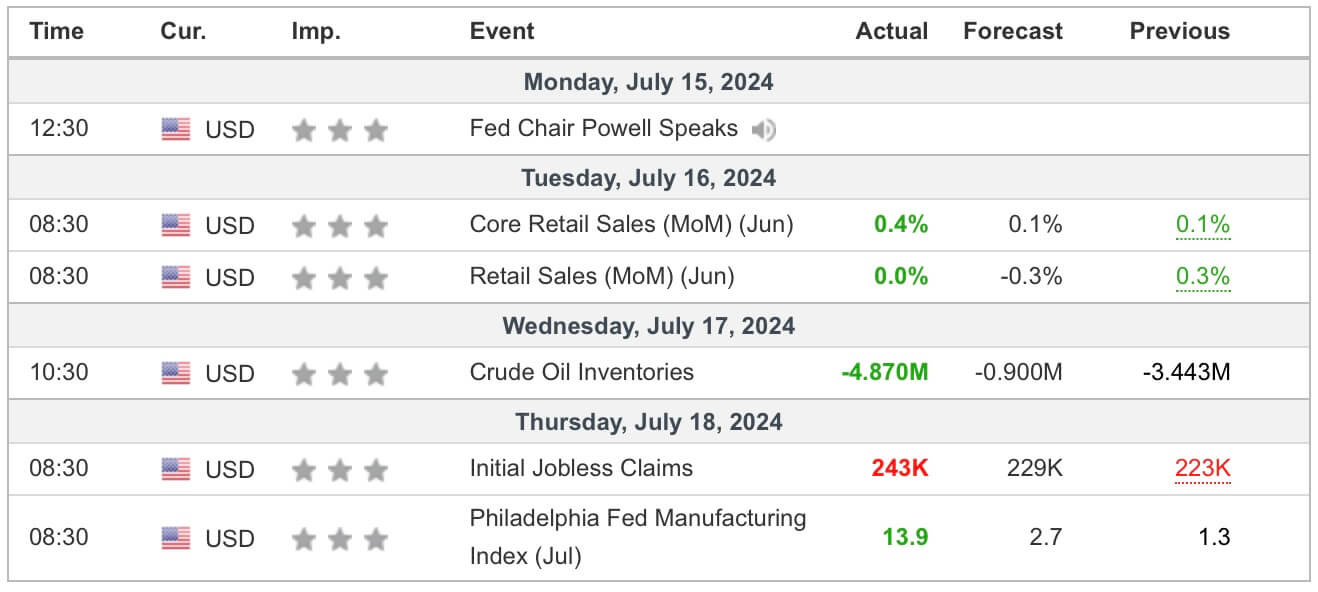

8. Major Economic Announcements

Initial Jobless Claims were 243K compared to the 229K forecast.

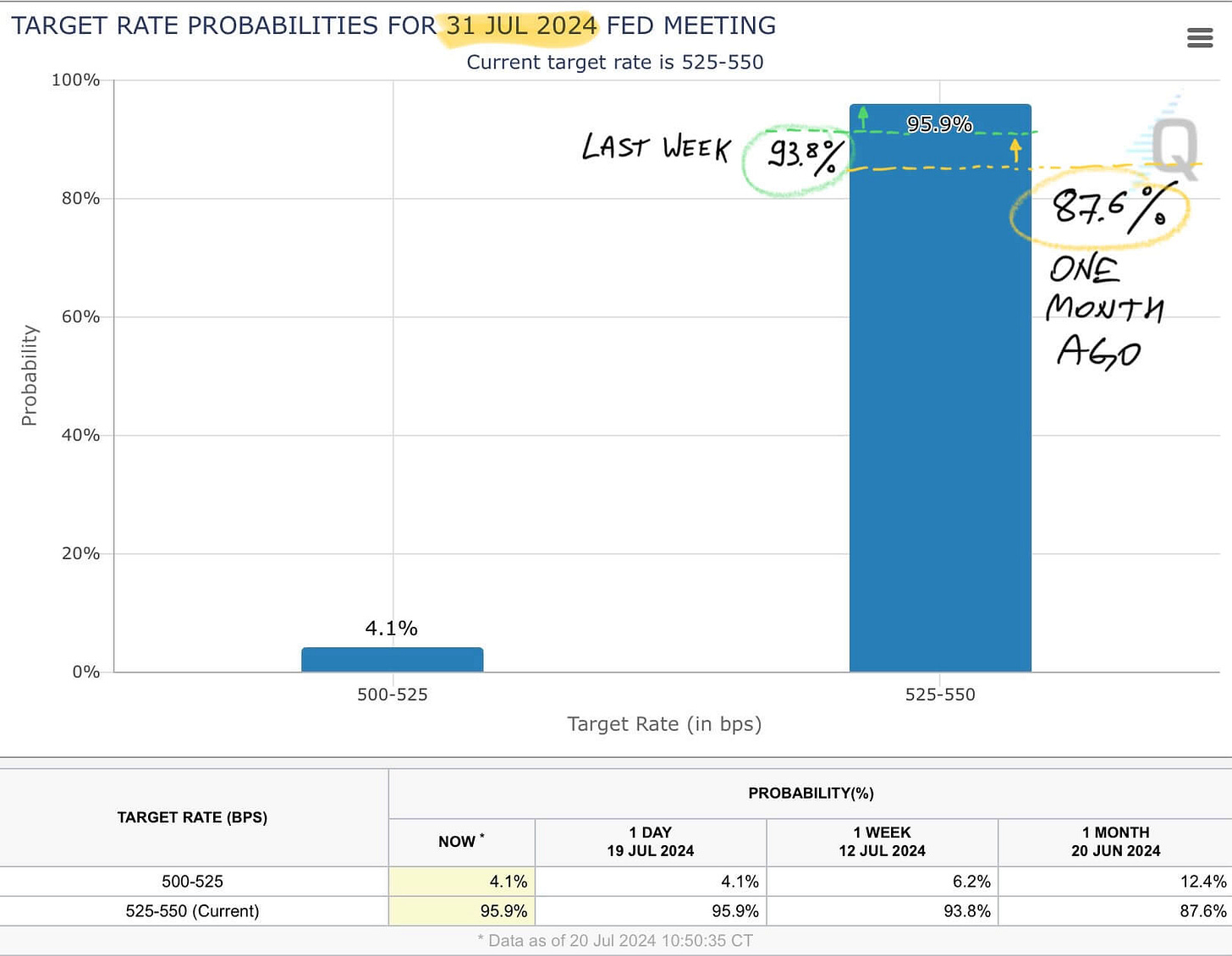

The probability of the FED leaving the interest rate unchanged during the July 31 meeting increased from 93.8% to 95.9%.

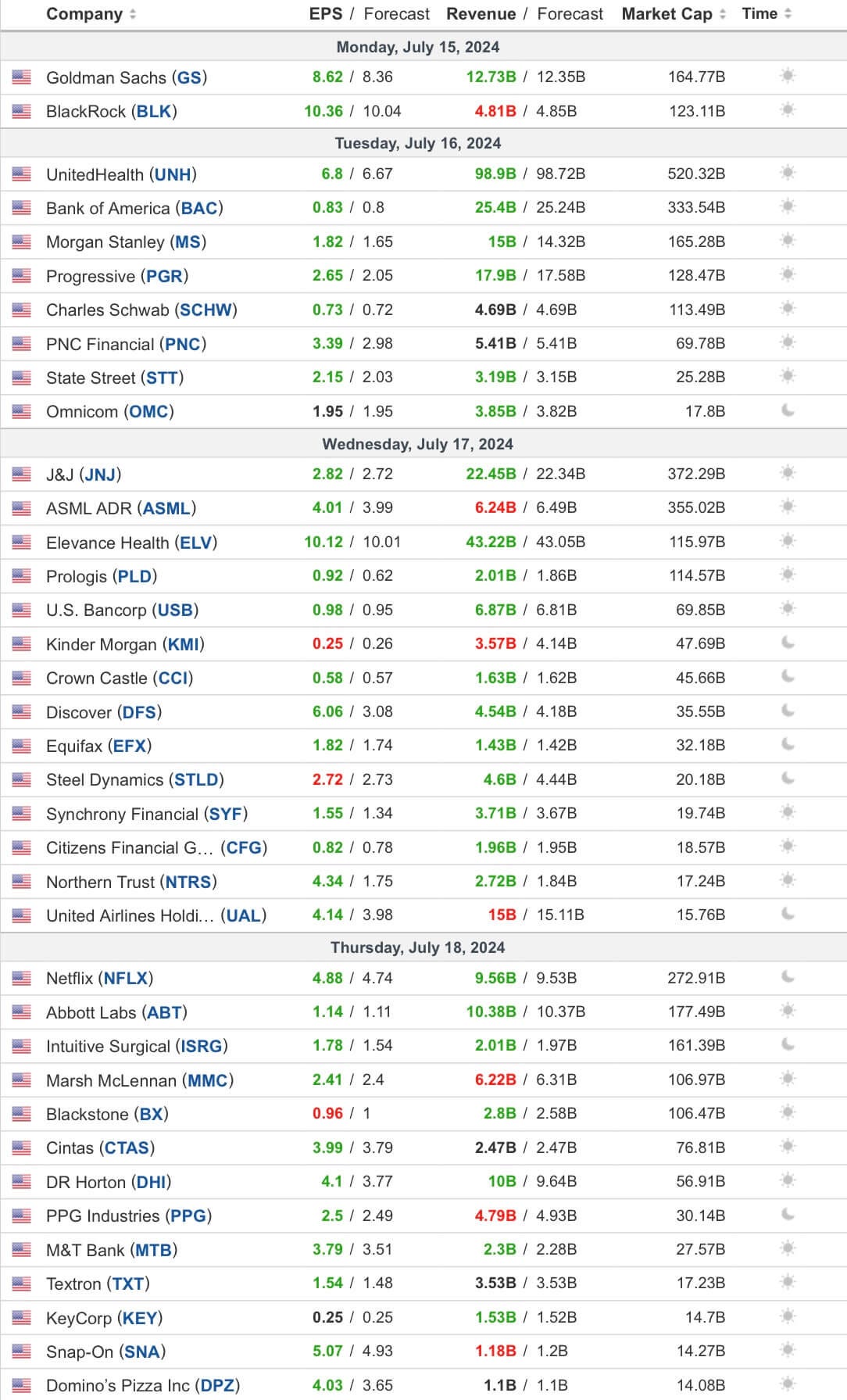

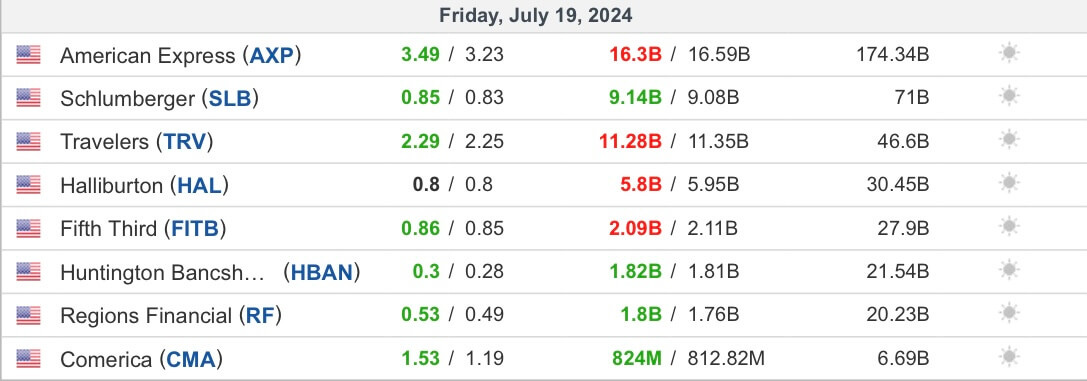

9. Earnings Reports

Goldman Sachs (GS) and BlackRock (BLK) reported earnings on Monday. UnitedHealth (UNH), Morgan Stanley (MS), and Bank of America (BAC) reported on Tuesday. J&J (JNJ), Netflix (NFLX), and American Express (AXP) followed on Wednesday, Thursday, and Friday.

Most of the companies that reported earnings this week managed to beat market expectations.

Next Week

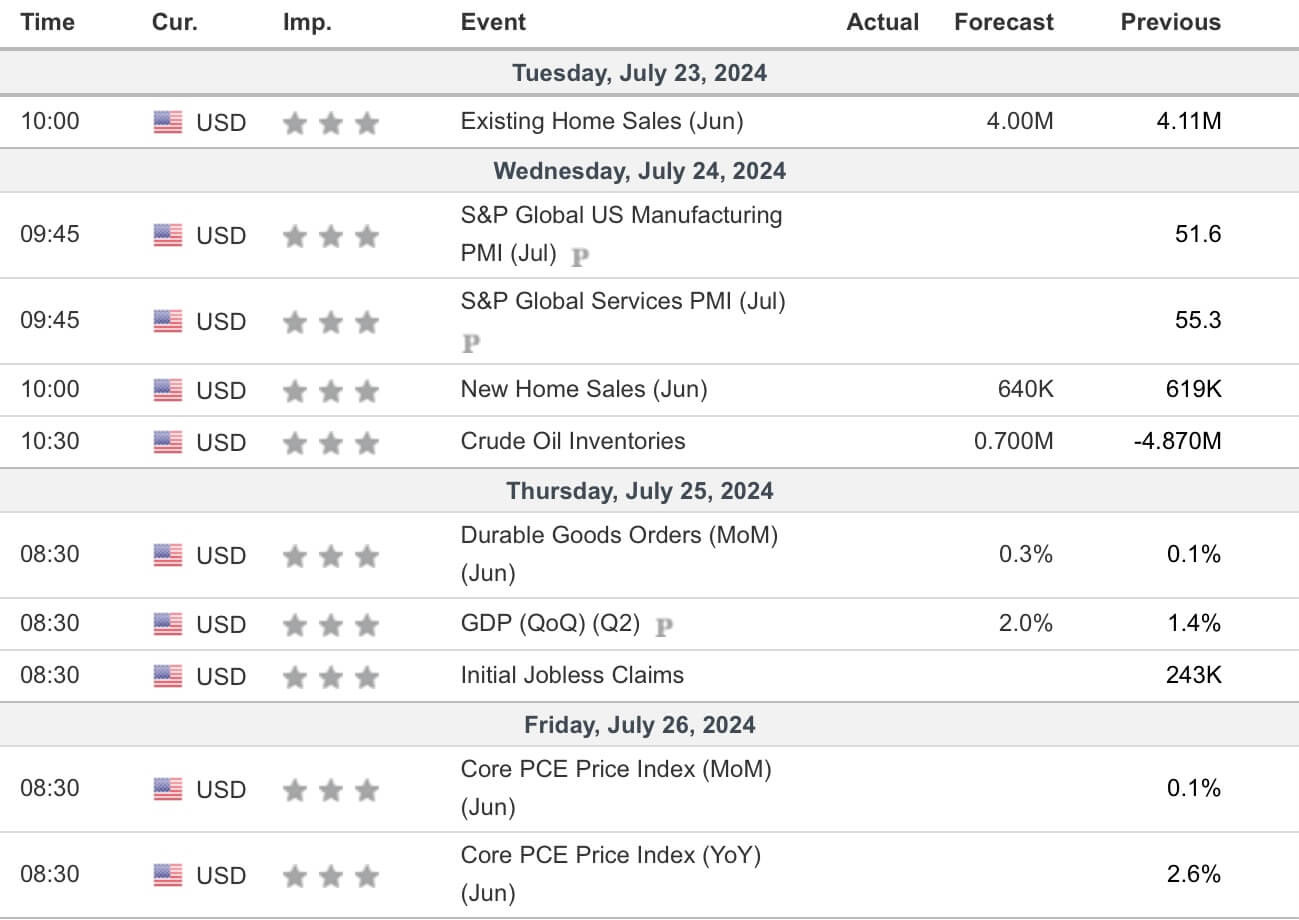

1. Major Economic Announcements

Next week, we will pay attention to the GDP (Q2) data coming out on Thursday and the Core PCE Price Index (inflation data) on Friday.

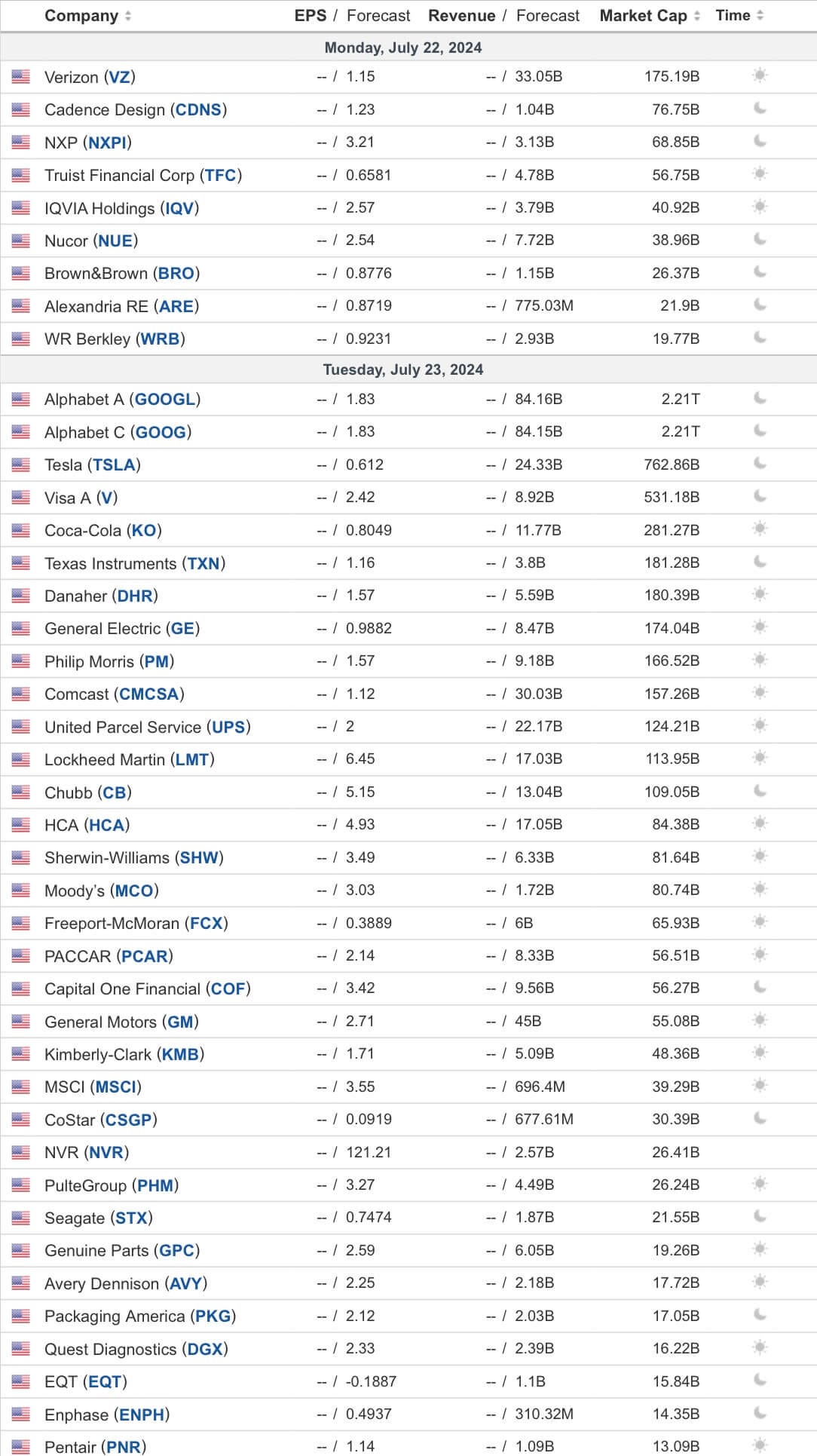

2. Earnings Reports

Verizon (VZ), Alphabet (GOOG), Tesla (TSLA), Visa (V), Coca-Cola (KO), AbbVie (ABBV), and Honeywell (HON) are among the largest companies to report earnings next week.

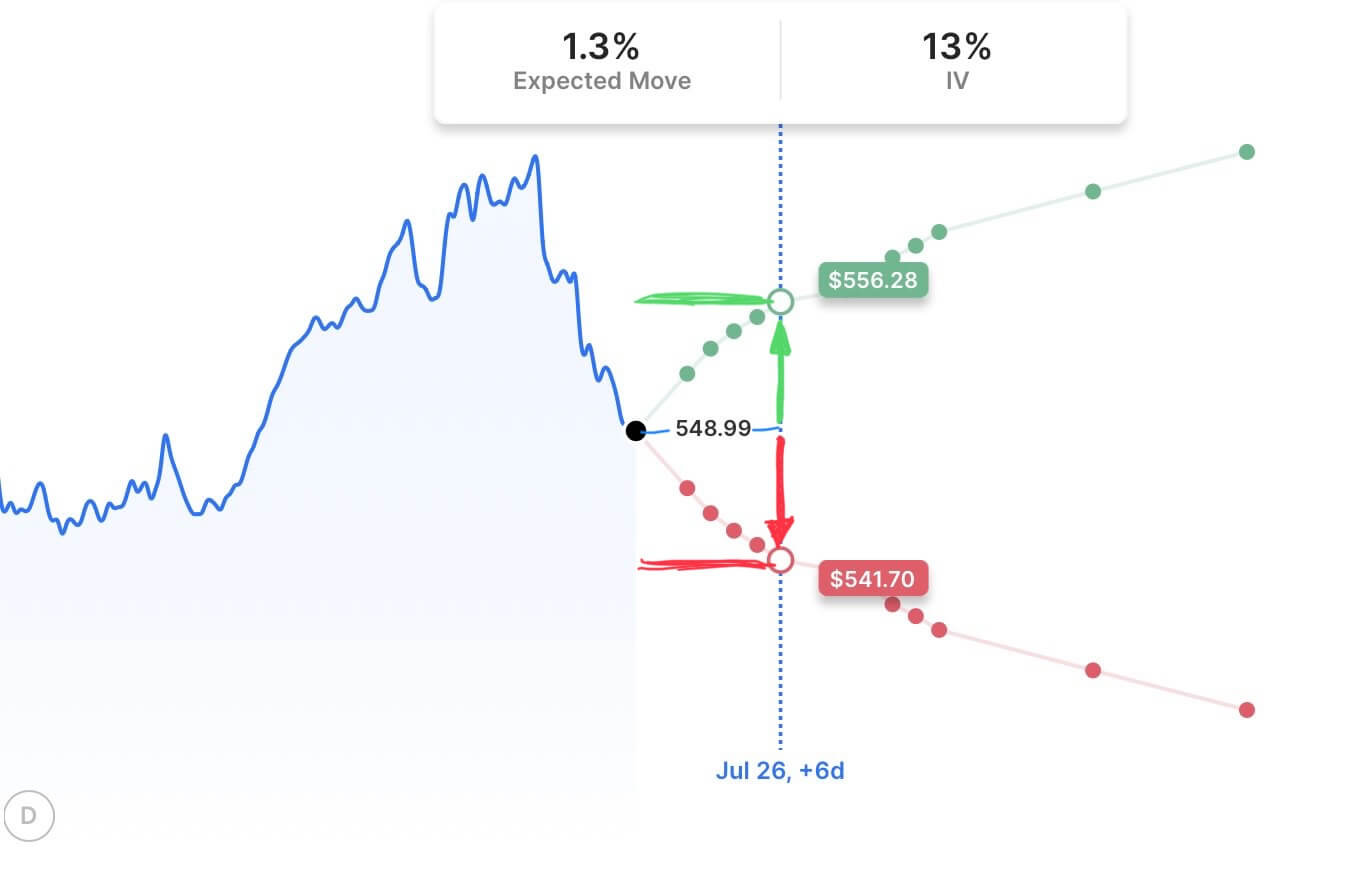

3. Expected Move

The options market anticipates that the S&P 500 is likely to move +/- 1.3% next week.

Happy trading and investing! 🤑📊🚀

The next email will be sent on Sunday (28 Jul 2024).