📈 Week 28 (8-14 July 2024) Market Summary

US Stocks (Major Indices), Sector and Asset Class rotation, The Magnificent Seven, Global Stock Indices, Volatility, Major Economics Announcements and Earnings Reports

Hello! 👋

Let’s see what we’ve been up to this week.

1. US Stocks (Major Indices)

Russell 2000 (RTY) was on the rise (+6.14%) after the CPI report on Thursday.

Nasdaq 100 returned +22.89% so far in 2024, S&P 500 - +18.40%, Russell 2000 +6.48% and Dow Jones Industrial Average +6.06% in 2024.

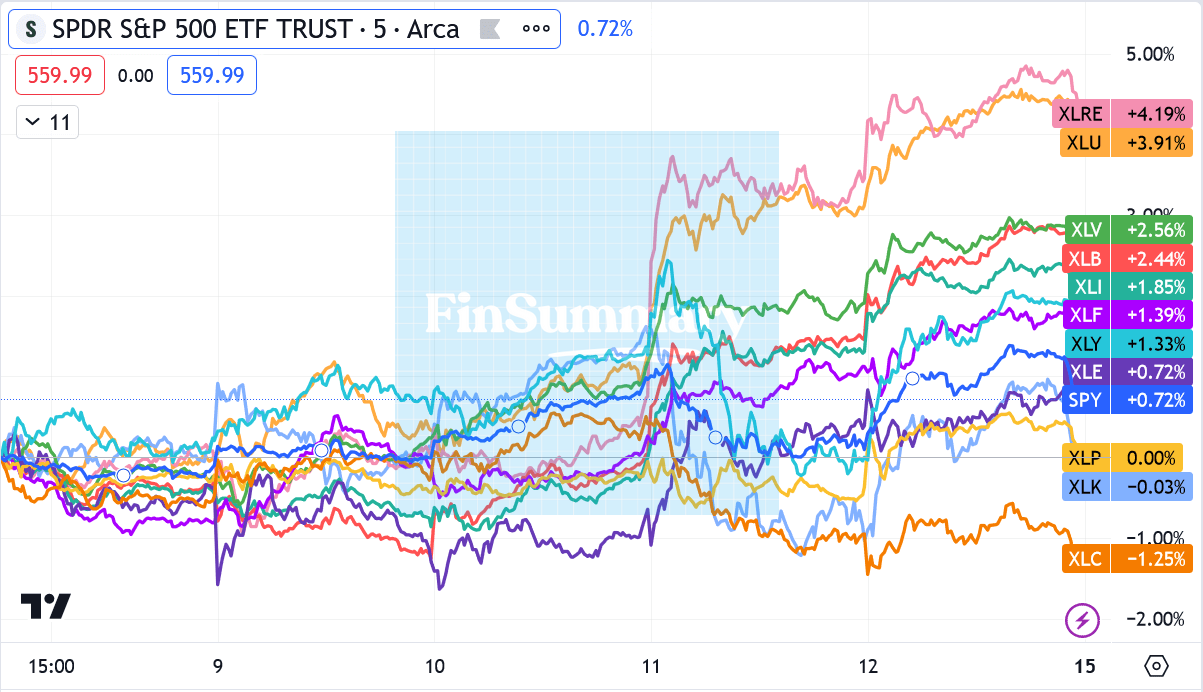

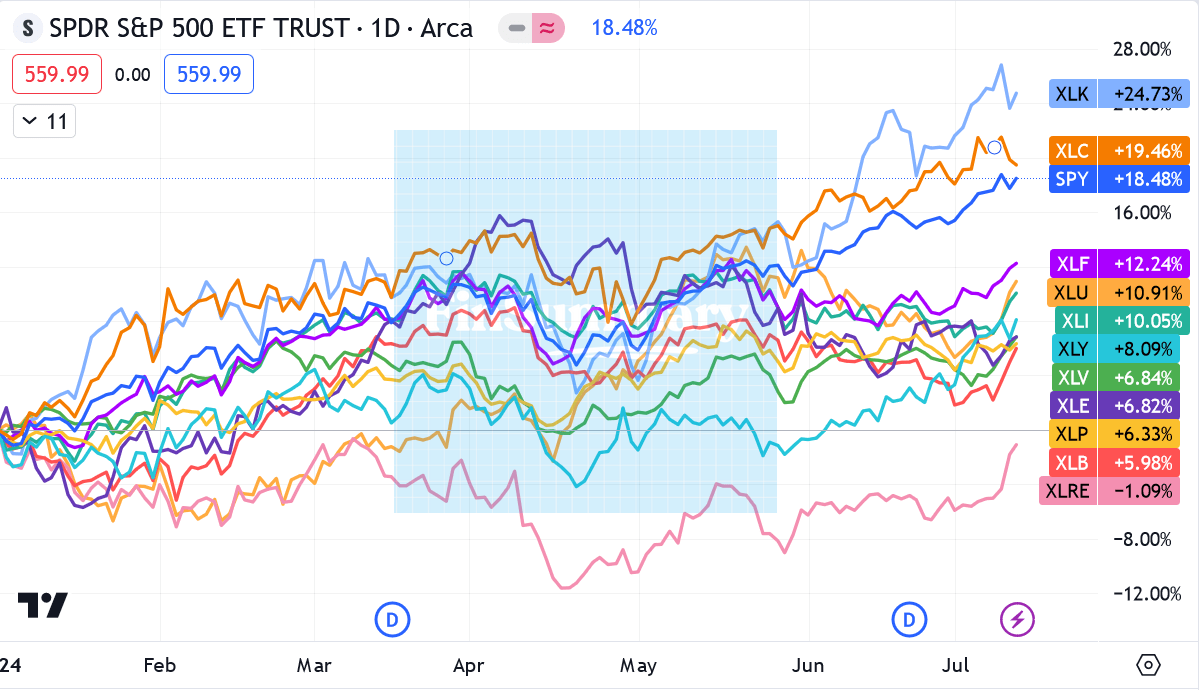

2. US Stocks by Sector

XLC - Communication Services,

XLK - Technology,

XLP - Consumer Staples,

XLE - Energy,

XLY - Consumer Discretionary,

XLF - Financials,

XLI - Industrials,

XLB - Materials,

XLV - Health Care,

XLU - Utilities,

XLRE - Real Estate,

SPY - S&P 500.

3. The “Magnificent Seven”

Apple Inc (AAPL), Microsoft Corp (MSFT), NVIDIA Corp (NVDA), Alphabet Inc (GOOG), Amazon.com Inc (AMZN), Meta Platforms Inc (META), Tesla Inc (TSLA).

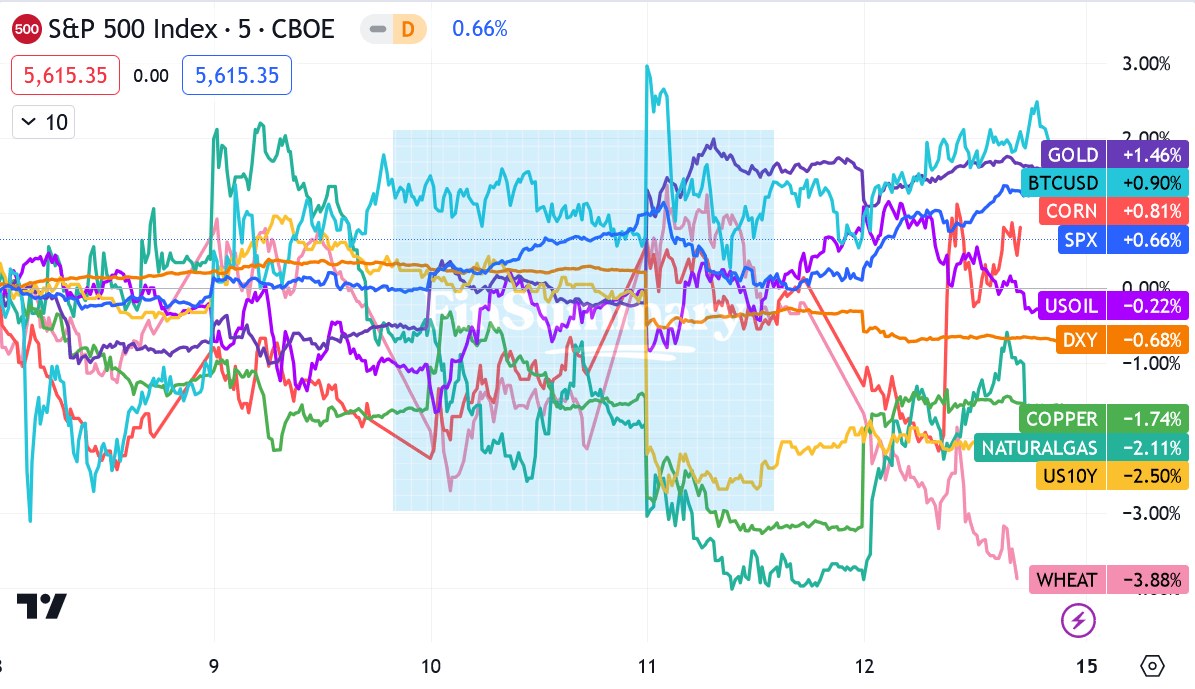

4. Asset Class Rotation (Stocks, Currencies, Commodities, Bonds)

Wheat (-9.26%), Corn (-13.36%) and Natural Gas (-8.39%) are down this year. US Treasuries are up 6.40%. Metals (Gold and Copper) and S&P500 are up almost 20%. Bitcoin is up 28.73%.

5. Global Stock Markets

USA (SPX) - S&P500 Index,

UK (UKX) - FTSE100 Index,

Europe (STOXX50) - EURO STOXX 50 Index,

Japan (NI225) - Nikkei225 Index,

China (HSI) - Hang Seng Index,

India (NIFTY) - Nifty50 Index,

Brazil (IBOV) - BOVESPA Index.

6. Volatility

VIX index closed around it’s 50-day Moving Average meaning that there is not much fear in the market.

Volatility of Volatility Index indicates that there is not much demand for VIX index based products, therefore not much hedging is going on.

7. US Treasuries

8. Major Economic Announcements

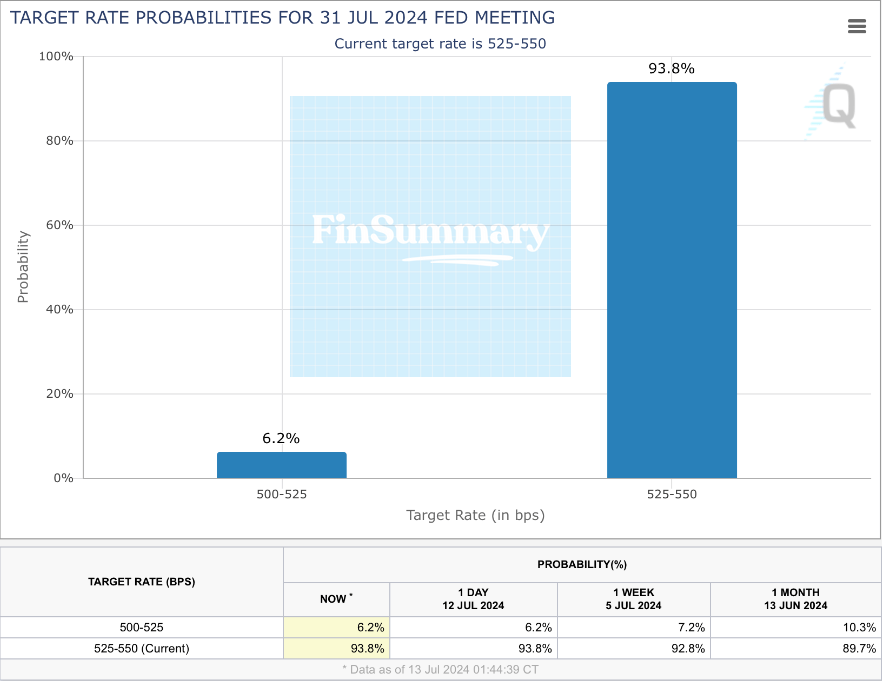

Inflation as measured by the Consumer Price Index fell 0.1% in June, its lowest monthly growth rate since May 2020. (read more)

U.S. producer prices (PPI) increased slightly more than expected in June amid a rise in the cost of services, but that did not change expectations that the Federal Reserve could start cutting interest rates in September. (read more)

9. Earnings Reports

JPMorgan Chase tops second-quarter revenue expectations on strong investment banking (CNBC).

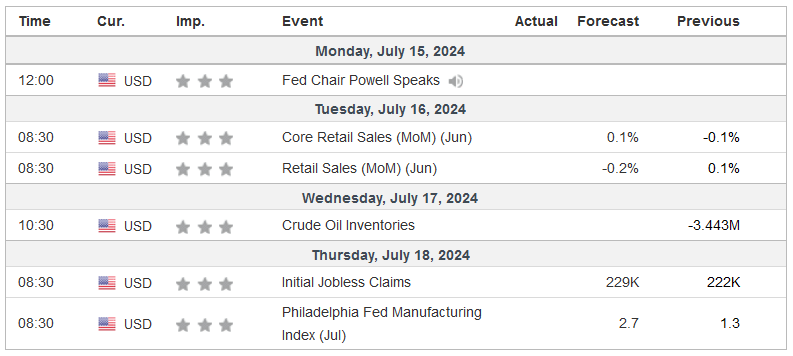

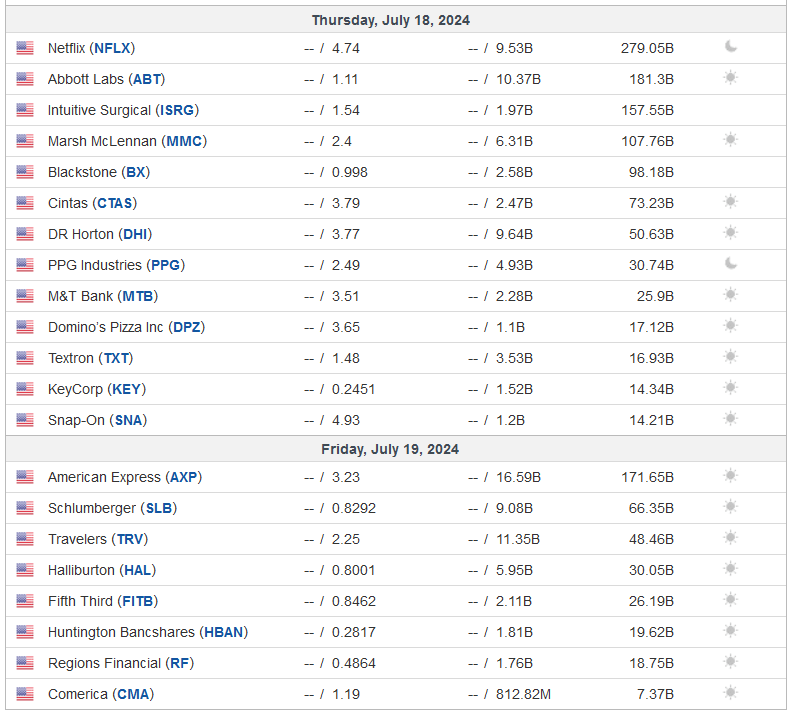

Next Week

1. Major Economic Announcements

2. Earnings Reports

3. Expected Move

Happy trading and investing! 🤑📊🚀

The next email will be sent on Sunday (21 Jul 2024).